The partnership between X and Y was dissolved on March 31, 2022. On that date their respective credits to the Capitals were ₹ 1,50,000 and ₹ 10,000. ₹ 1,20,000 were due to creditors

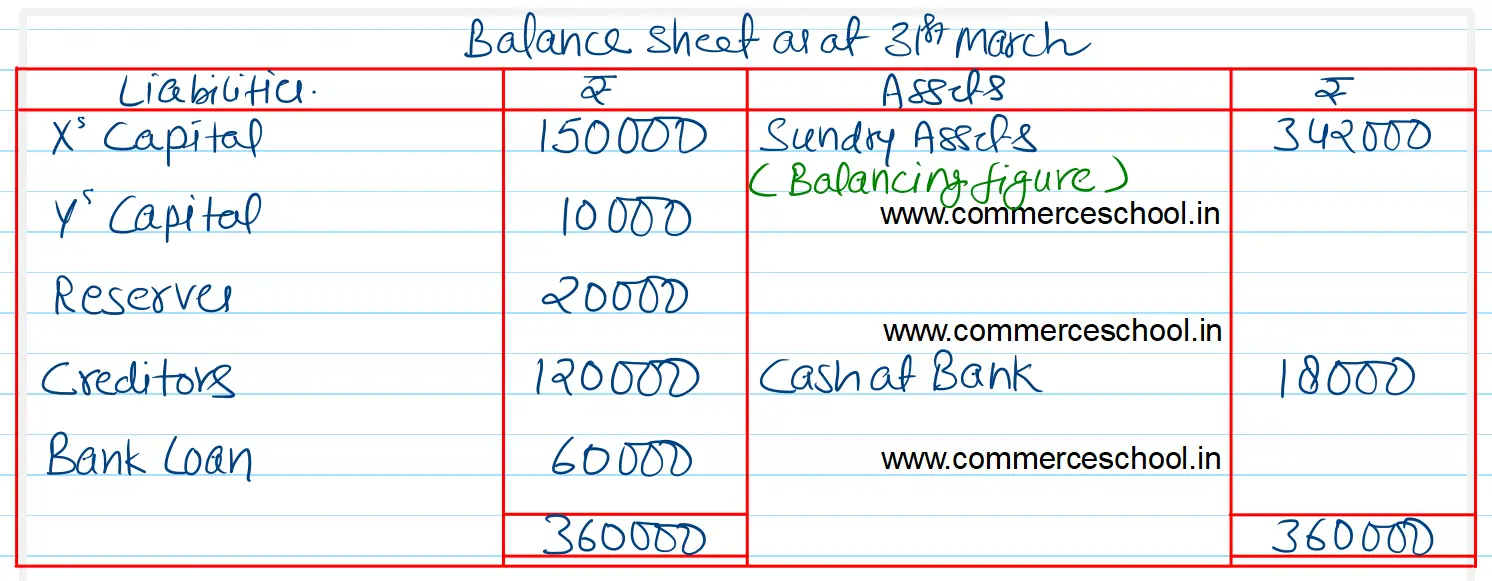

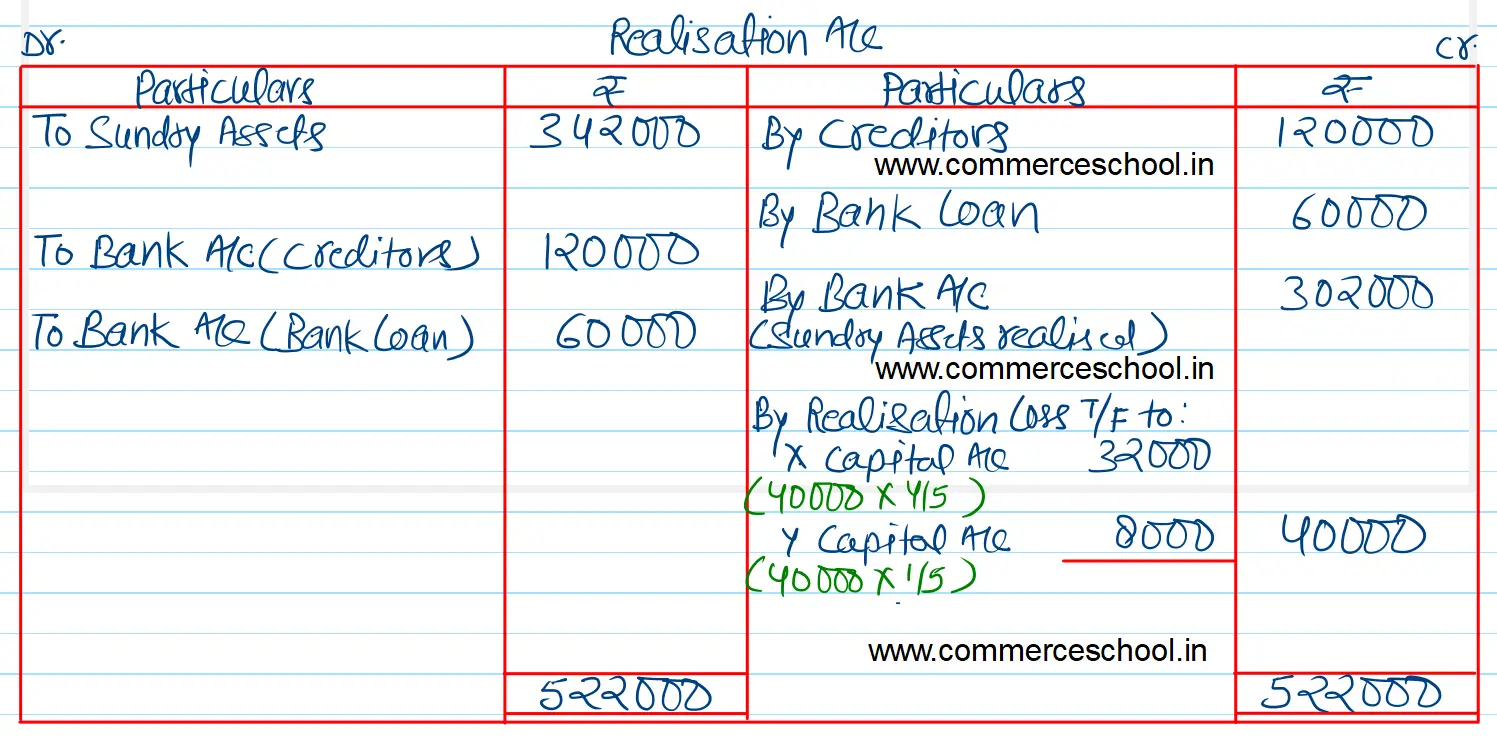

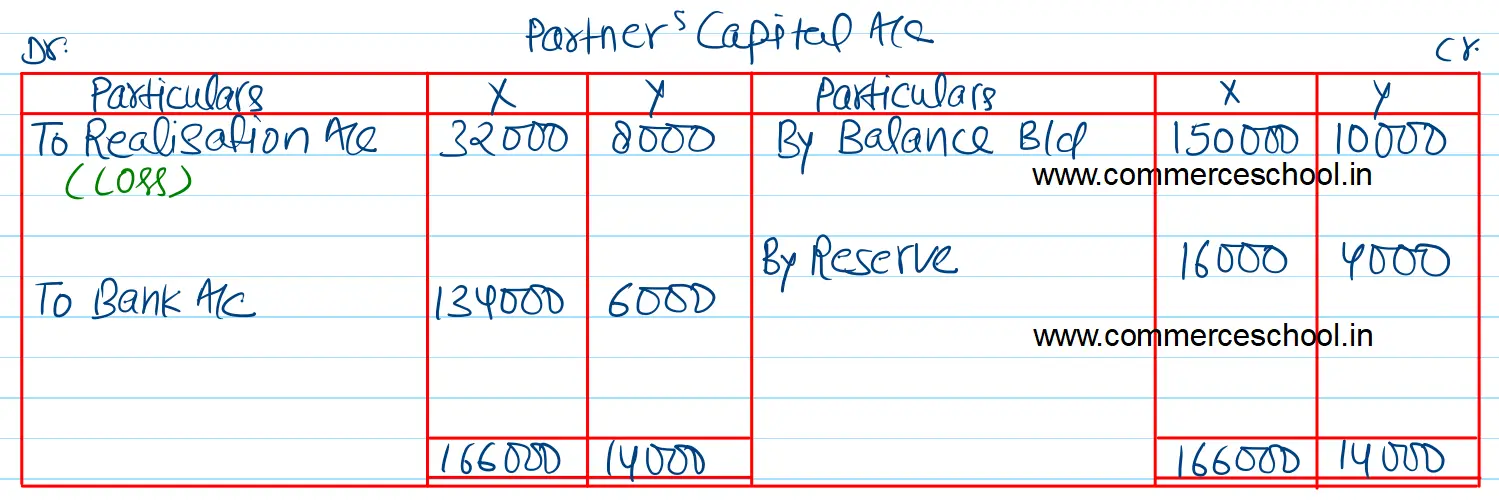

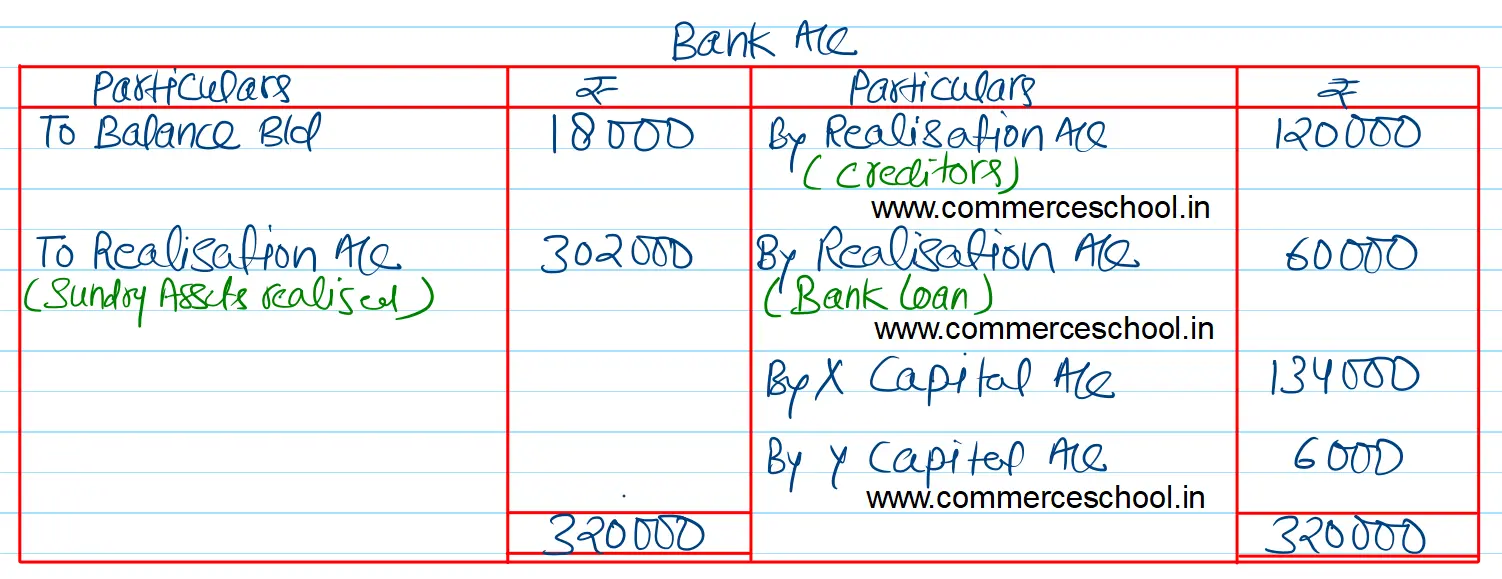

The partnership between X and Y was dissolved on March 31, 2022. On that date their respective credits to the Capitals were ₹ 1,50,000 and ₹ 10,000. ₹ 1,20,000 were due to creditors. ₹ 60,000 were due for Bank Loan and Reserve has been maintained for ₹ 20,000. X and Y shared profits in the ratio of 4 : 1. Cash balance of ₹ 18,000 was also kept in the firm. Assets realised ₹ 3,02,000. Prepare Memorandum Balance Sheet, Realisation Account; Partner’s Capital Accounts and Cash Account.

[Ans. Book value of assets (other than Cash) ₹ 3,42,000; Loss on Realisation ₹ 40,000; Final Payment to X ₹ 1,34,000 and Y ₹ 6,000. Total of Cash Account ₹ 3,20,000.]

Anurag Pathak Answered question September 30, 2024