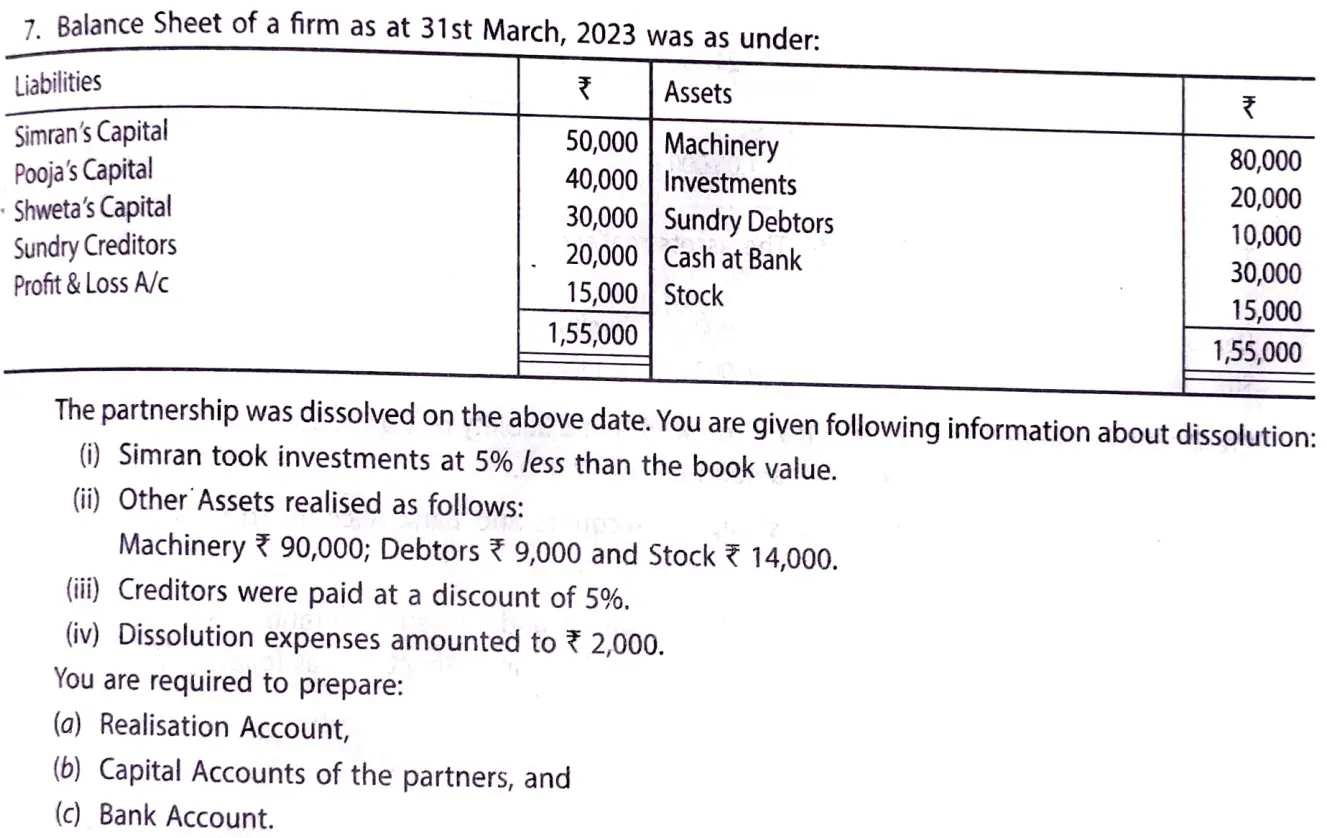

Balance Sheet of a firm as at 31st March, 2023 was as under:

Balance Sheet of a firm as at 31st March, 2023 was as under:

| Liabilities | ₹ | Assets | ₹ |

|

Simran’s Capital Pooja’s Capital Shweta’s Capital Sundry Creditors Profit & Loss A/c |

50,000 40,000 30,000 20,000 15,000 |

Machinery Investments Sundry Debtors Cash at Bank Stock |

80,000 20,000 10,000 30,000 15,000 |

| 1,55,000 | 1,55,000 |

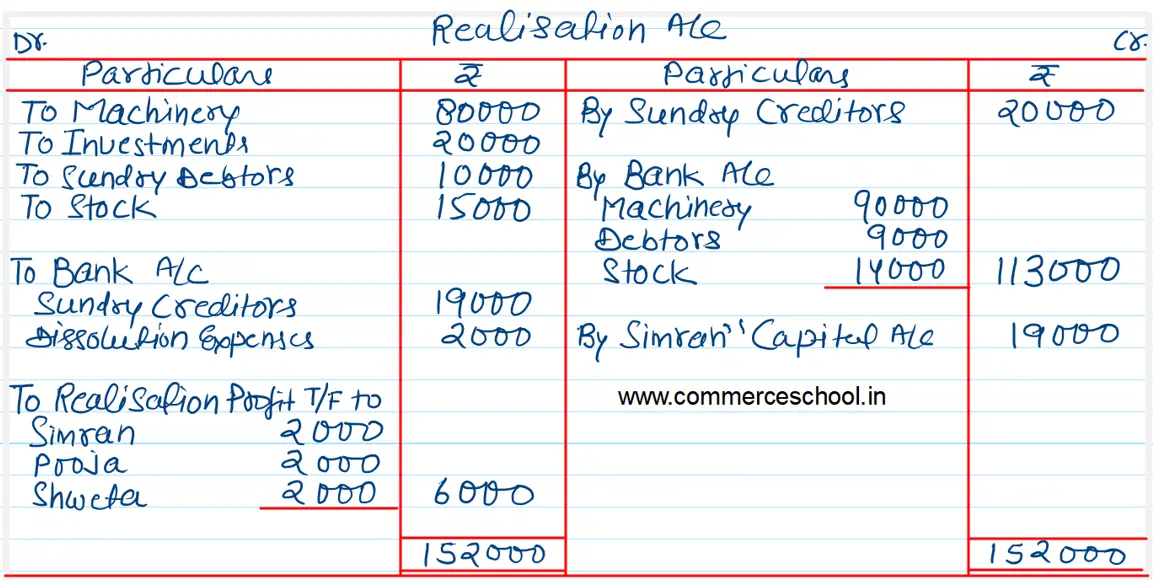

The partnership was dissolved on the above date. You are given following information about dissolution:

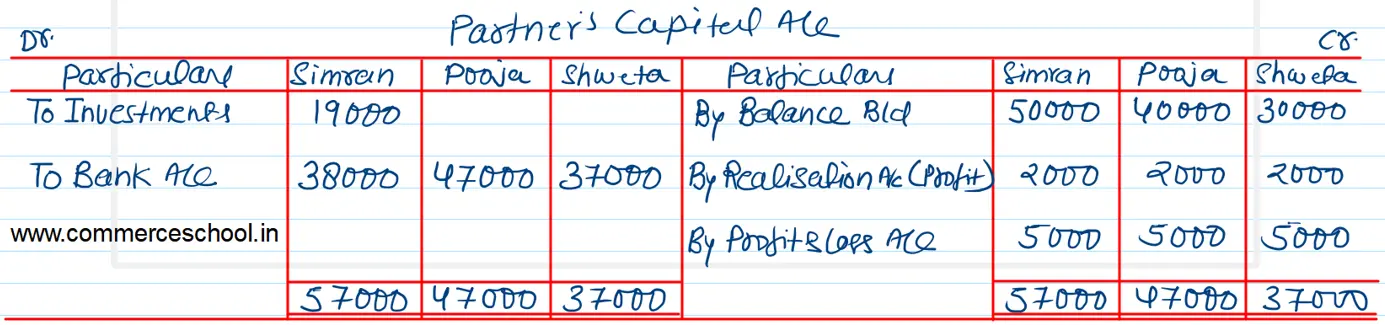

(i) Simran took investments at 5% less than the book value.

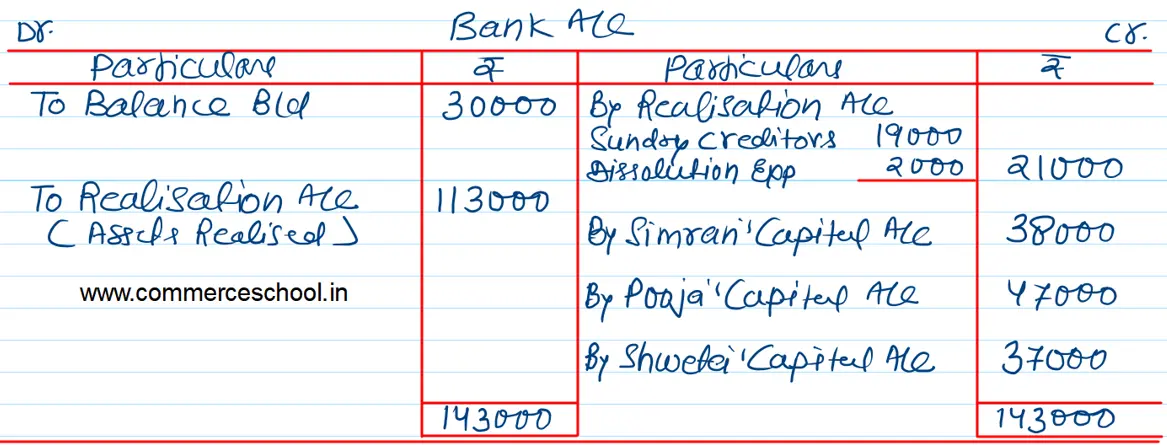

(ii) Other Assets realised as follows:

Machinery ₹ 90,000; Debtors ₹ 9,000 and Stock ₹ 14,000.

(iii) Creditors were paid at a discount of 5%.

(iv) Dissolution expenses amounted to ₹ 2,000.

You are required to prepare:

(a) Realisation Account,

(b) Capital Accounts of the partners, and

(c) Bank Account.

Anurag Pathak Changed status to publish