A and B were partners sharing profits and losses as to 7/11th to A and 4/11th to B. They dissolved the partnership on 30th May, 2022.

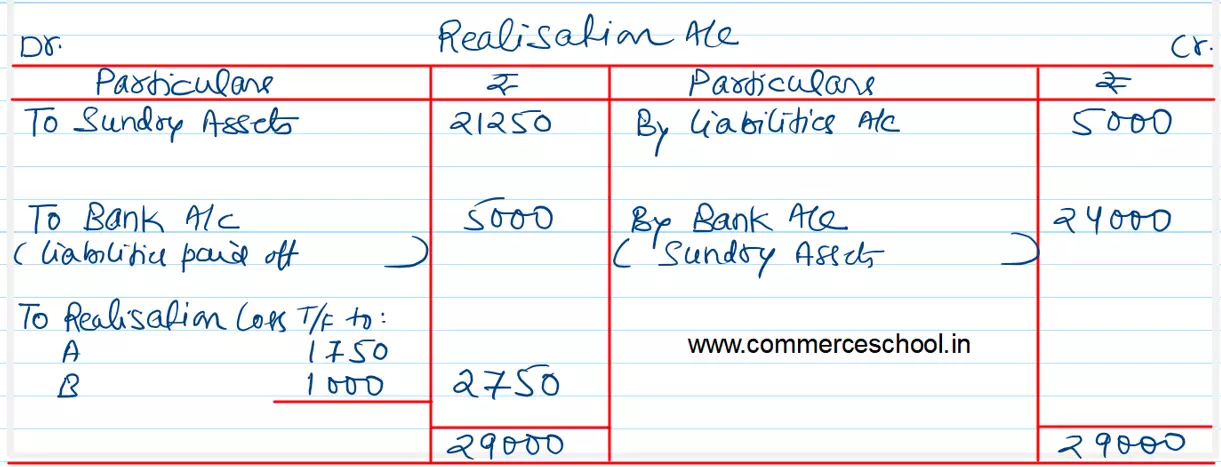

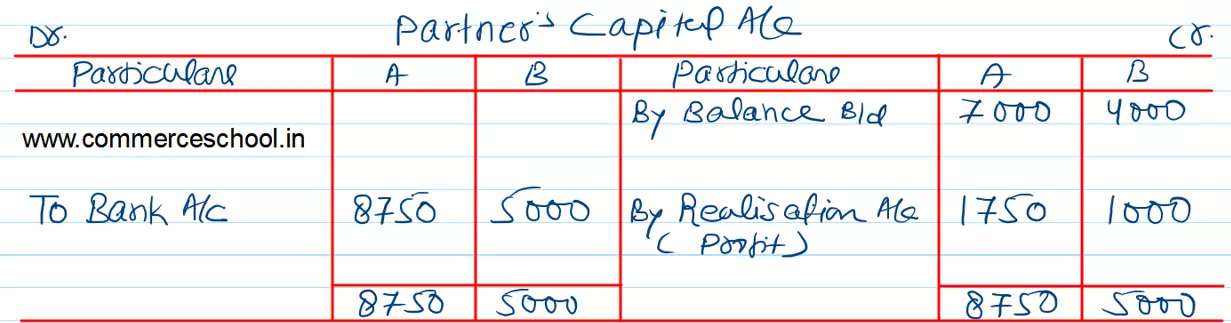

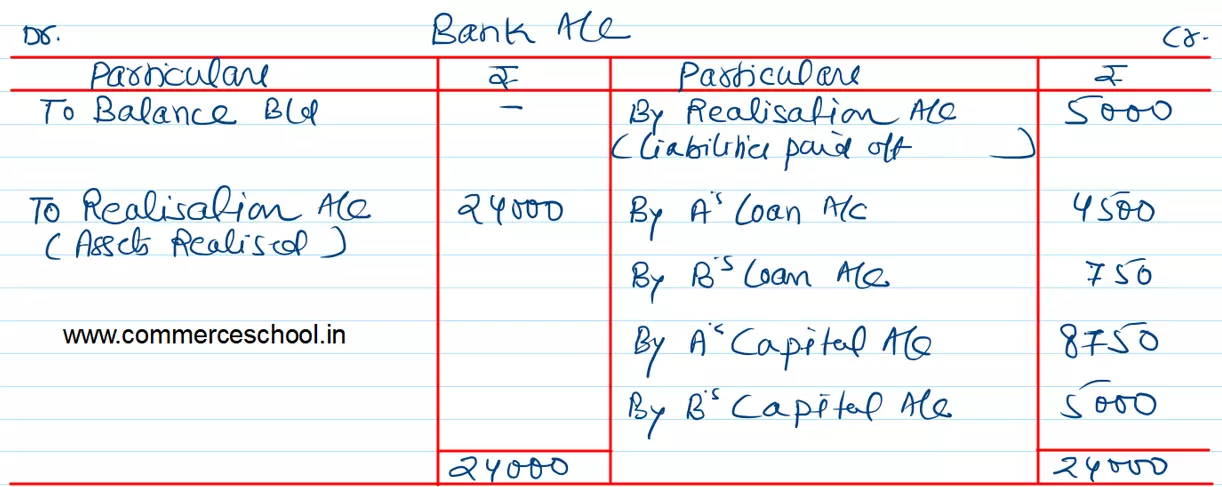

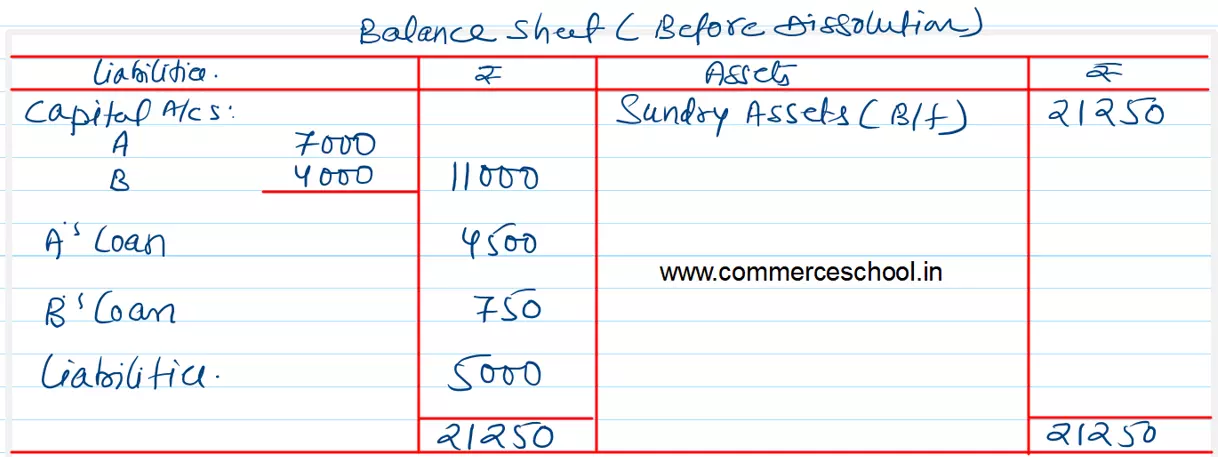

A and B were partners sharing profits and losses as to 7/11th to A and 4/11th to B. They dissolved the partnership on 30th May, 2022. As on that date their capitals were: A ₹ 7,000 and B ₹ 4,000. There were also due on Loan A/c to A ₹ 4,500 and to B ₹ 750. The other liabilities amounted to ₹ 5,000. The assets proved to have been undervalued in the last Balance Sheet and actually realised ₹ 24,000. Prepare necessary accounts showing the final settlement between partners.

Anurag Pathak Changed status to publish July 31, 2023