A, B and C started business on 1st April, 2022 with capitals of ₹ 1,00,000; ₹ 80,000 and ₹ 60,000 respectively sharing profits (losses) in the ratio of 4 : 3 : 3.

A, B and C started business on 1st April, 2022 with capitals of ₹ 1,00,000; ₹ 80,000 and ₹ 60,000 respectively sharing profits (losses) in the ratio of 4 : 3 : 3. For the year ended 31st March, 2023, firm incurred loss of ₹ 50,000. Each of the partners withdrew ₹ 10,000 during the year. On 31st March, 2023, the firm was dissolved, the creditors of the firm stood at ₹ 24,000 on that date and Cash in Hand was ₹ 4,000. The assets realised ₹ 3,00,000 and Creditors were paid ₹ 23,500 in full settlement of their claims. Prepare Realisation Account and show your workings clearly.

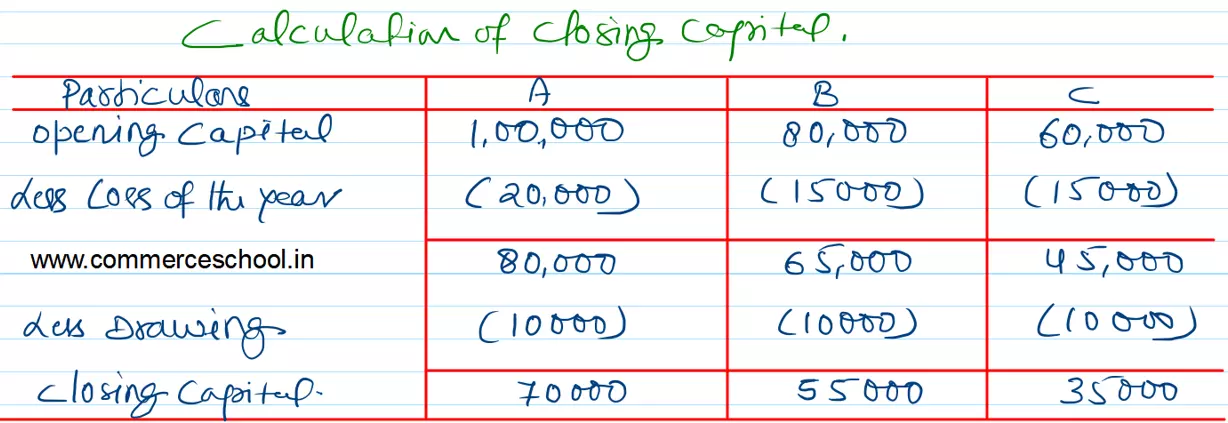

[Ans.: Gain (profit) on Realisation – ₹ 1,20,500; Capital as on 31st March, 2022 A – ₹ 70,000; B – ₹ 55,000; C – ₹ 35,000; Sundry Assets – ₹ 1,80,000.]