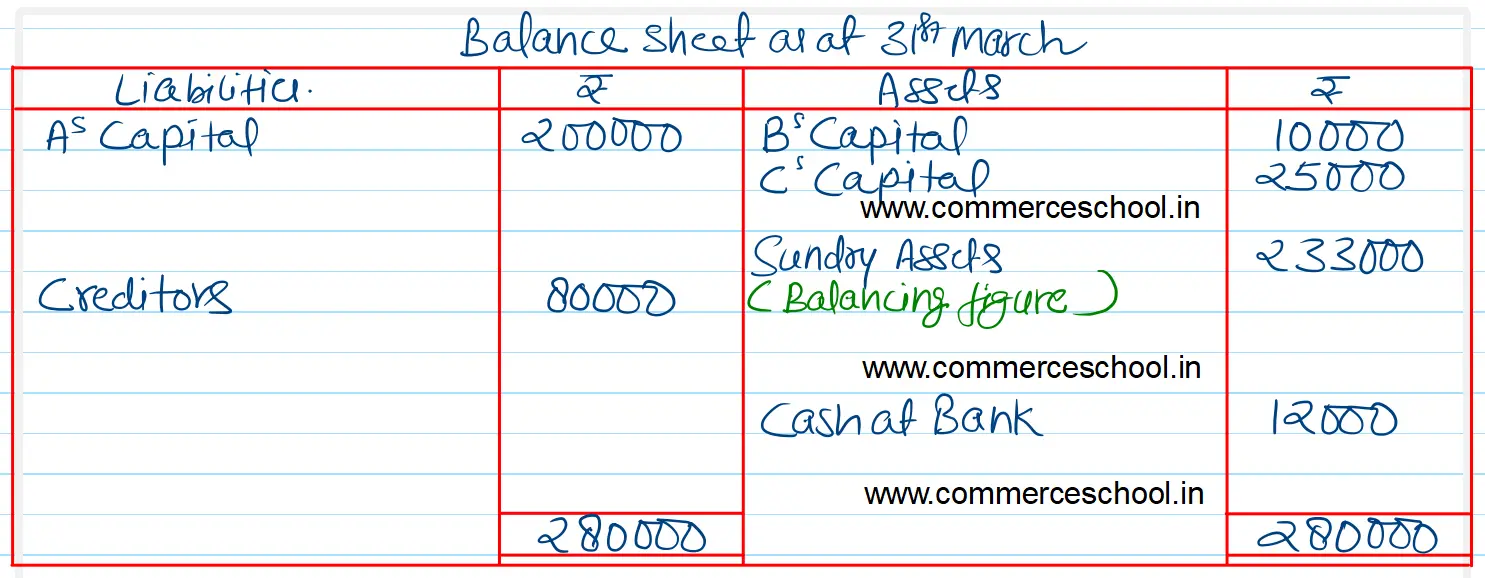

A, B and C were partners in a firm sharing profits in the ratio of 5 : 3 : 2. On 1-4-2022 they decided to dissolve the firm. On that date A’s Capital was ₹ 2,00,000, B’s Capital was ₹ 10,000 (Dr.) and C’s Capital was ₹ 25,000 (Dr.)

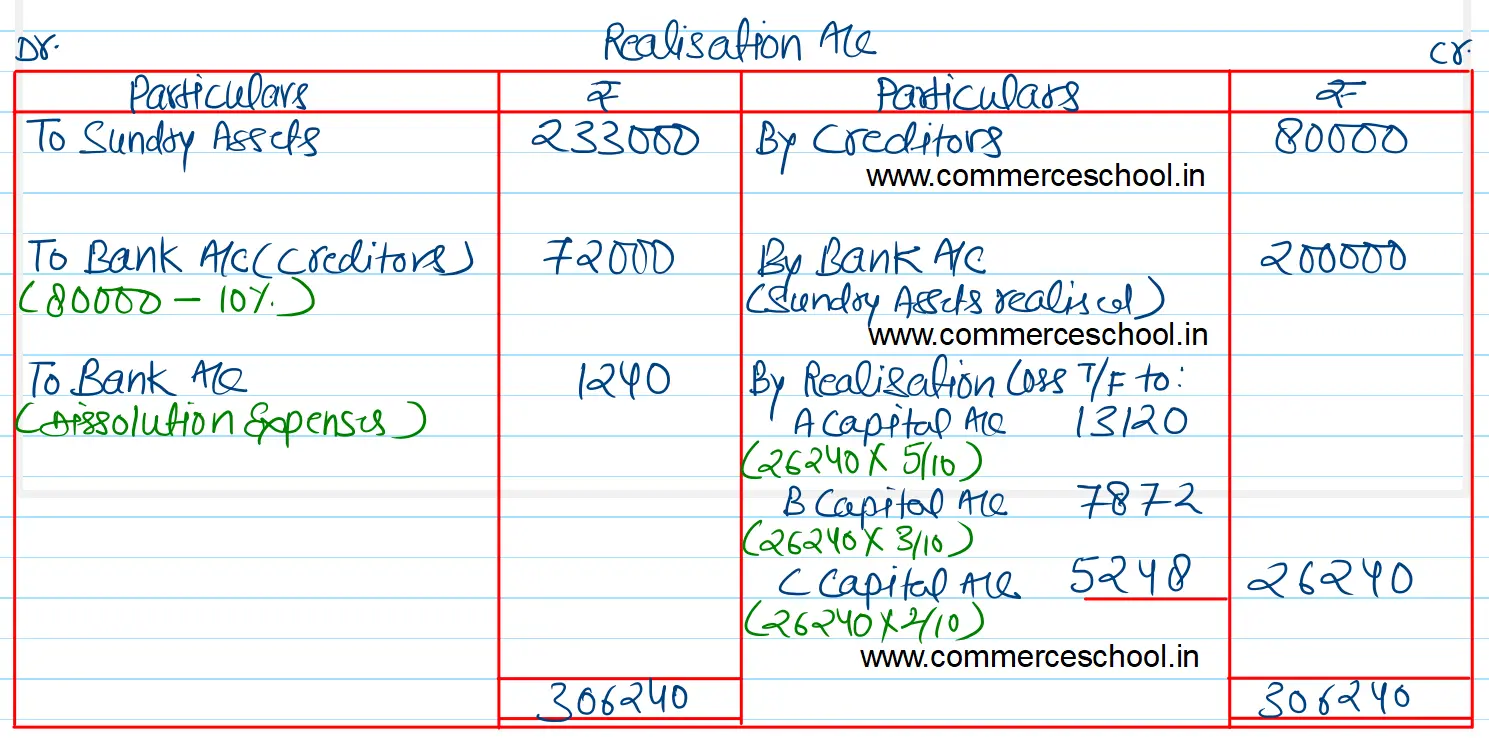

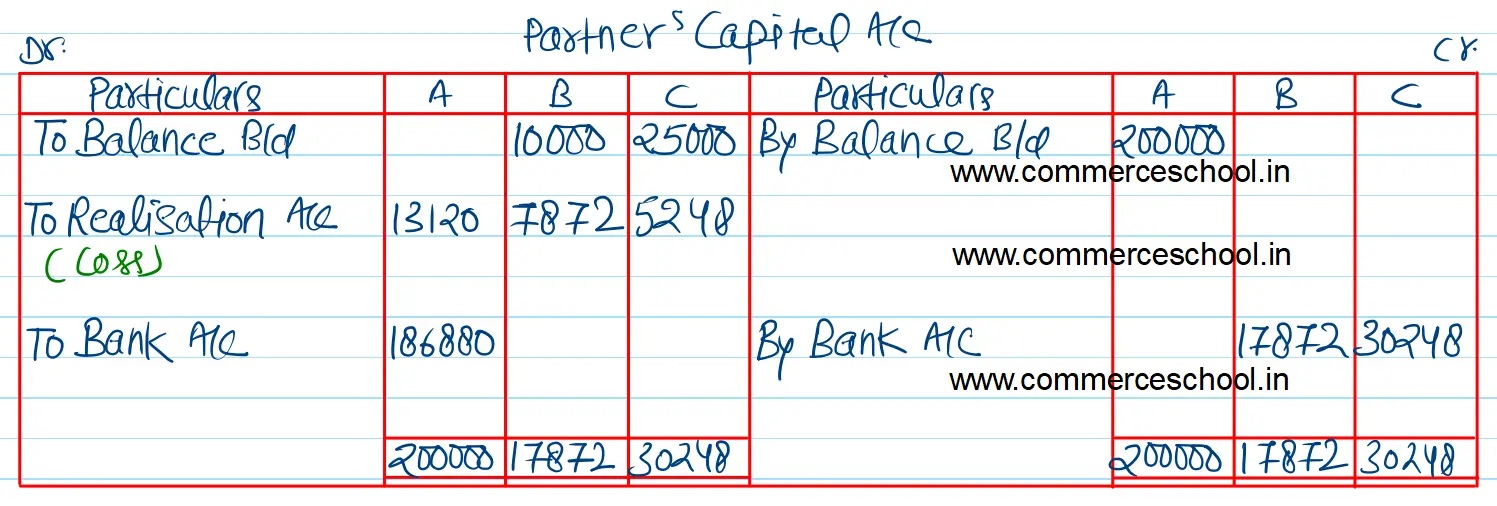

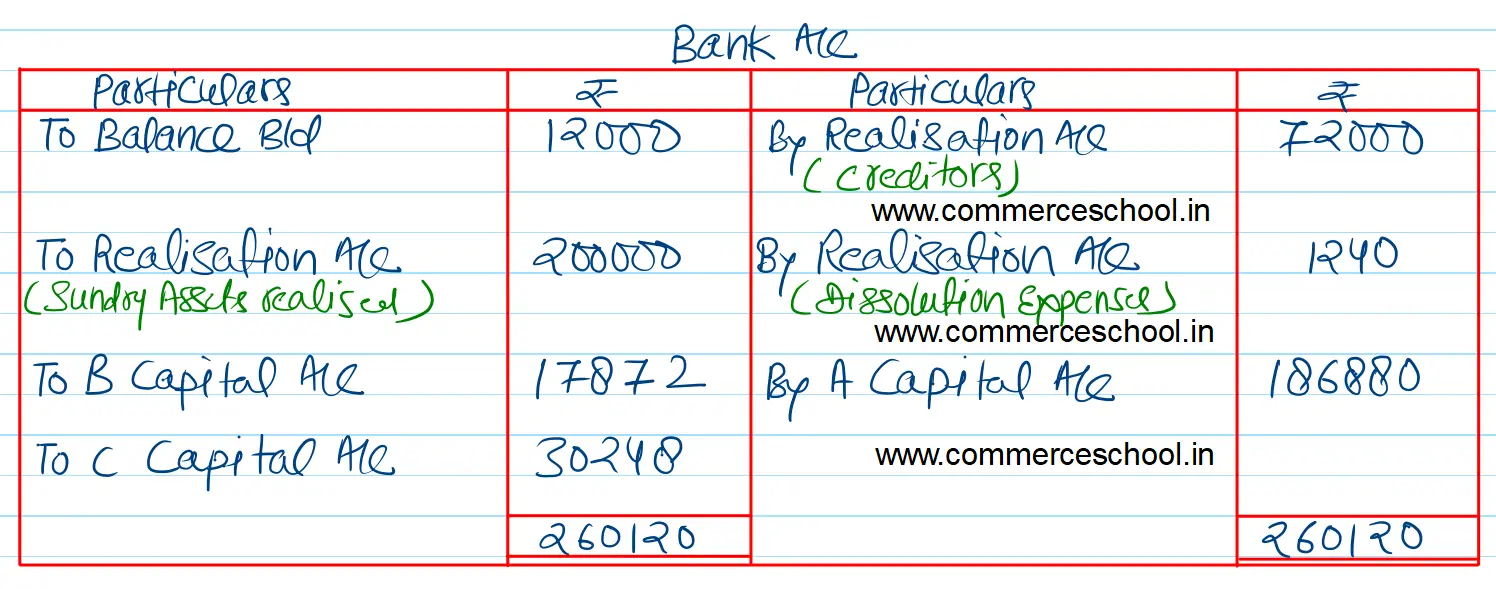

A, B and C were partners in a firm sharing profits in the ratio of 5 : 3 : 2. On 1-4-2022 they decided to dissolve the firm. On that date A’s Capital was ₹ 2,00,000, B’s Capital was ₹ 10,000 (Dr.) and C’s Capital was ₹ 25,000 (Dr.). The Creditors amounted to ₹ 80,000 and Cash balance was ₹ 12,000. The assets realised ₹ 2,00,000; Creditors were paid at a discount of 10% and the expenses of dissolution were ₹ 1,240. All partners were solvent. Prepare realisation account, partner’s capital accounts and the cash account.

[Ans. Book Value of Assets (other than Cash) ₹ 2,33,000; Loss on Realisation ₹ 26,240; Cash paid to A ₹ 1,86,880; Cash brought in by B ₹ 17,872 and by C ₹ 30,248; Total of Cash Account ₹ 2,60,120.]