Adiraj and Karan were partners in a firm sharing profits and losses in the ratio of 3 : 2. On 31st March, 2018 the firm was dissolved. After the transfer of assets

Adiraj and Karan were partners in a firm sharing profits and losses in the ratio of 3 : 2. On 31st March, 2018 the firm was dissolved. After the transfer of assets (other than cash in hand and at bank) and third party liabilities to the Realisation Account, the following information was provided:

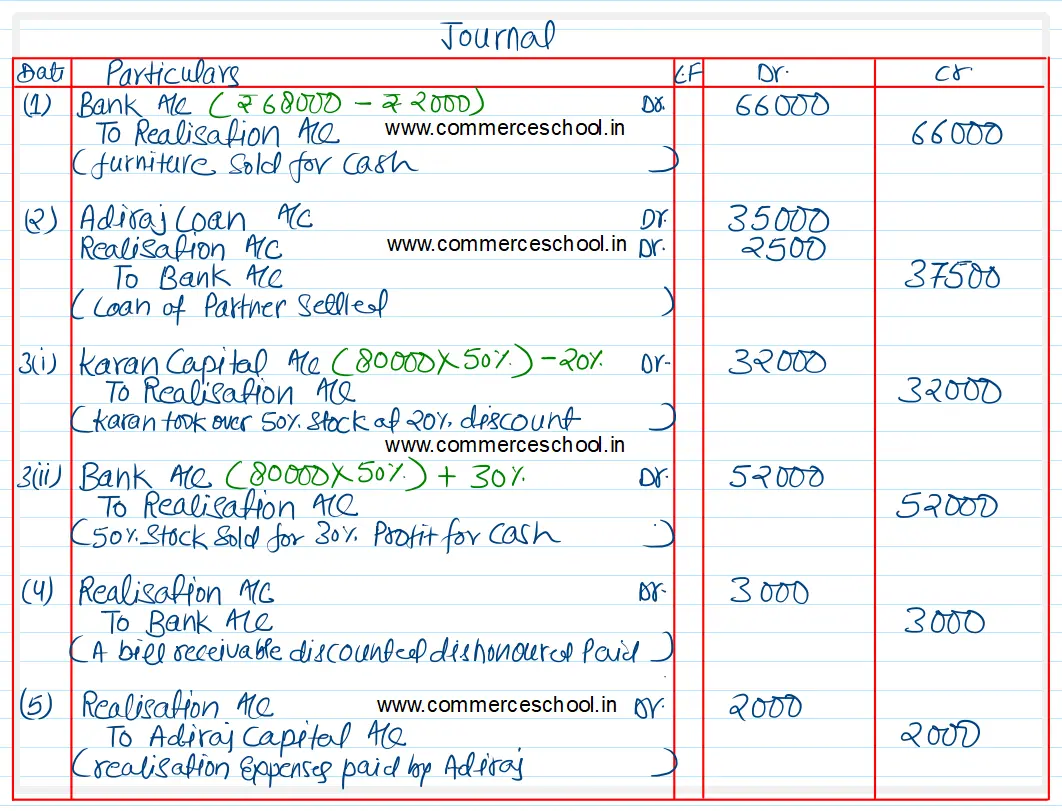

(I) Furniture of ₹ 70,000 was sold for ₹ 68,000 by auction and auctioneers commission amounted to ₹ 2,000.

(ii) Adiraj’s loan amounting to ₹ 35,000 was settled at ₹ 37,500.

(iii) Out of the stock of ₹ 80,000, Karan took over 50% of the stock at a discount of 20% while the remaining stock was sold off at a profit of 30% on cost.

(iv) A bills receivable of ₹ 3,000 under discount was dishonoured as the acceptor had become insolvent and hence the bill had to be met by the firm.

(v) Realisation expenses amounted to ₹ 2,000 which were paid by Adiraj.

Pass the necessary journal entries for the above transactions on the dissolution of the firm.