Amol and Ameet are partners sharing profits and losses in the ratio of 2 : 1. They admit Atul for 1/4th share. For the purpose of admission of Atul, goodwill of the firm is to be valued on the basis of 2 year purchase of Average Super Profit of last four years. The normal rate of return in their business is 12% on capital employed.

Amol and Ameet are partners sharing profits and losses in the ratio of 2 : 1. They admit Atul for 1/4th share. For the purpose of admission of Atul, goodwill of the firm is to be valued on the basis of 2 year purchase of Average Super Profit of last four years. The normal rate of return in their business is 12% on capital employed.

Balance Sheet of the firm gives following details:

- Fixed Assets – ₹ 2,10,000

- Current Assets – ₹ 1,40,000

- Current Liabilities = ₹ 35,000

Profits of last 4 years ending on 31st March, are:

| 2020 (₹) | 2021 (₹) | 2022 (₹) | 2023 (₹) |

| 1,10,000 | 1,00,000 | 98,000 | 1,24,000 |

I. Value of goodwill of the firm on Atul’s admission was

a) ₹ 70,200

b) ₹ 1,05,200

c) ₹ 1,40,400

d) ₹ 1,08,000

II. Atul brings 60% of his share of goodwill. The account to be debited to record his compensation will be

a) Premium for Goodwill A/c ₹ 21,060

b) Atul’s Current A/c ₹ 14,040

c) Both a) and b)

d) Premium for Goodwill A/c ₹ 35,100

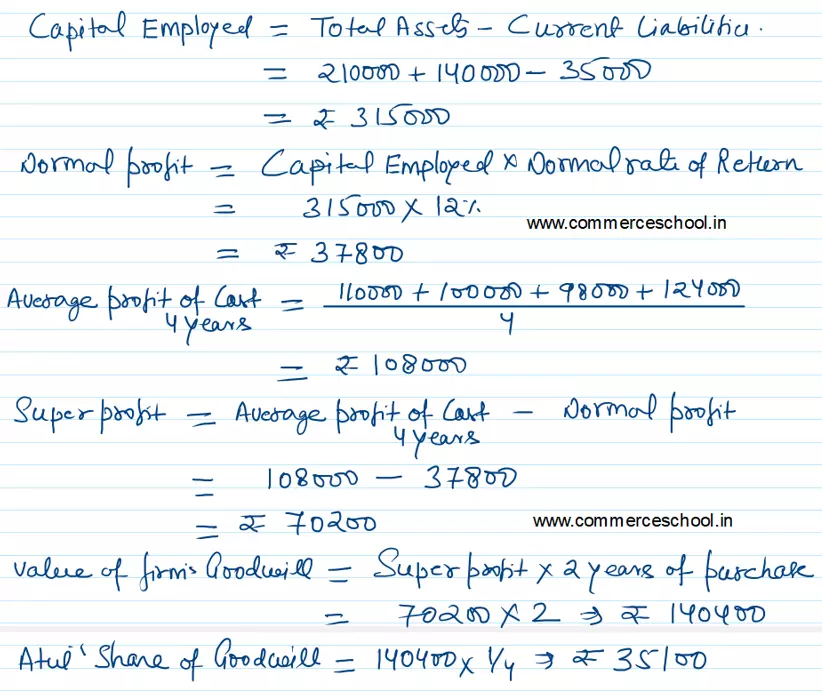

Solution – I

Ans – c)

Working Notes:-

Solution – II

Ans – c)

Explanation:-

Atul’s share of goodwill = ₹ 35,100

60% brought in cash = 35,100 × 60% = ₹ 21060

premium for goodwill account is debited by ₹ 21060

rest 14040 is debited through his current account.

Thus the entry is

Premium for goodwill A/c Dr. 21060

Atul’s Current A/c Dr. 14040

To Amol’s Capital A/c 23,400

To Ameet’s Capital A/c 11,700