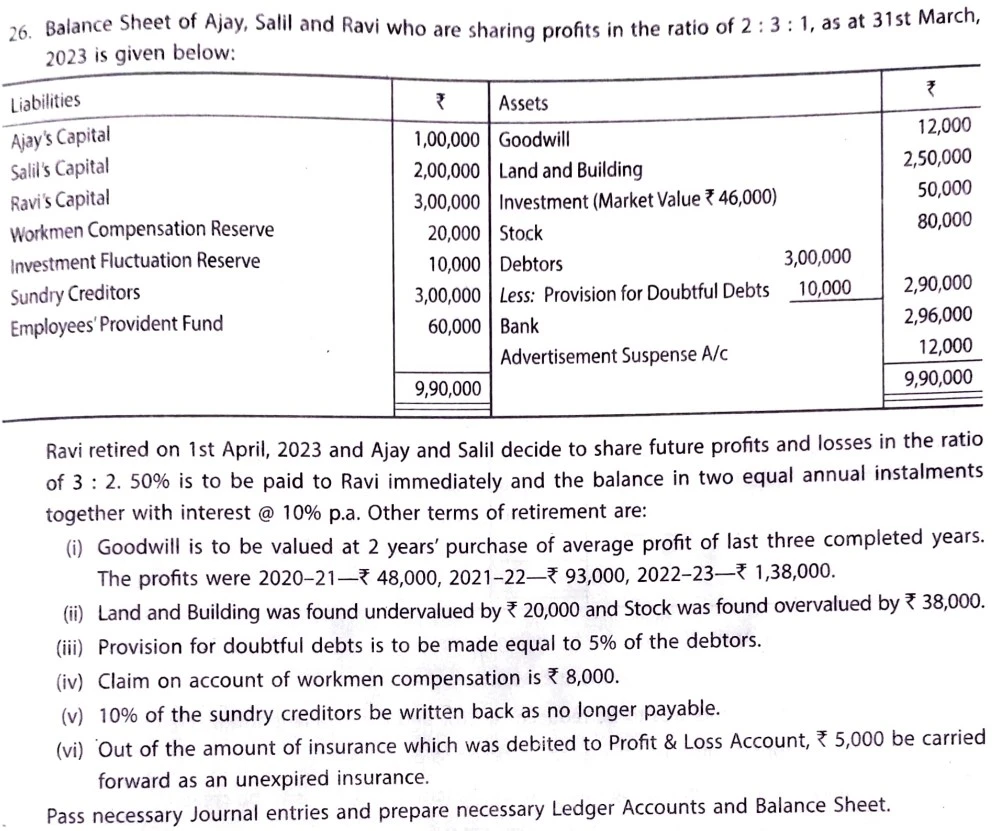

Balance Sheet of Ajay, Salil and Ravi who are sharing profits in the ratio of 2 : 3 : 1, as at 31st March, 2023 is given below:

Balance Sheet of Ajay, Salil and Ravi who are sharing profits in the ratio of 2 : 3 : 1, as at 31st March, 2023 is given below:

| Liabilities | ₹ | Assets | ₹ | |

|

Ajay’s Capital Salil’s Capital Ravi’s Capital Workmen Compensation Reserve Investment Fluctuation Reserve Sundry Creditors Employee’s Provident Fund |

1,00,000 2,00,000 3,00,000 20,000 10,000 3,00,000 60,000 |

Goodwill Land and Building Investment (Market Value ₹ 46,000) Stock Debtors Less: PDD Bank Advertisement Suspense A/c |

3,00,000 10,000 |

12,000 2,50,000 50,000 80,000

2,90,000 2,96,000 12,000 |

| 9,90,000 | 9,90,000 |

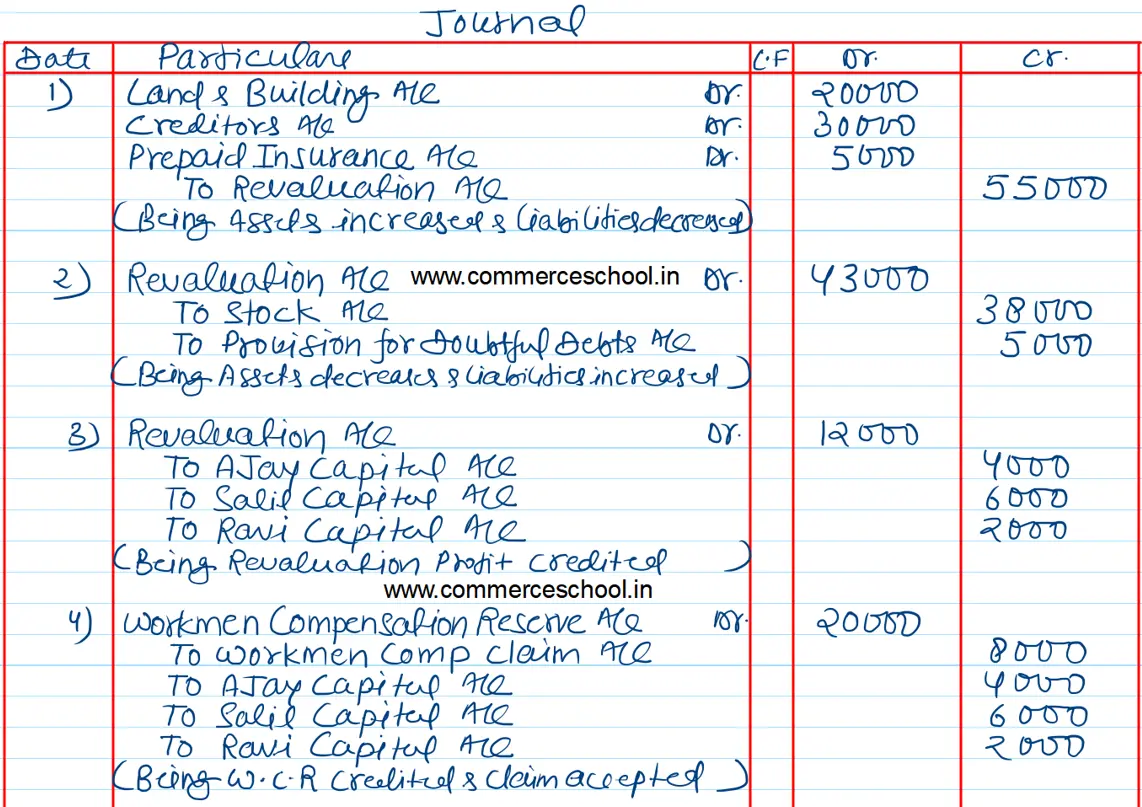

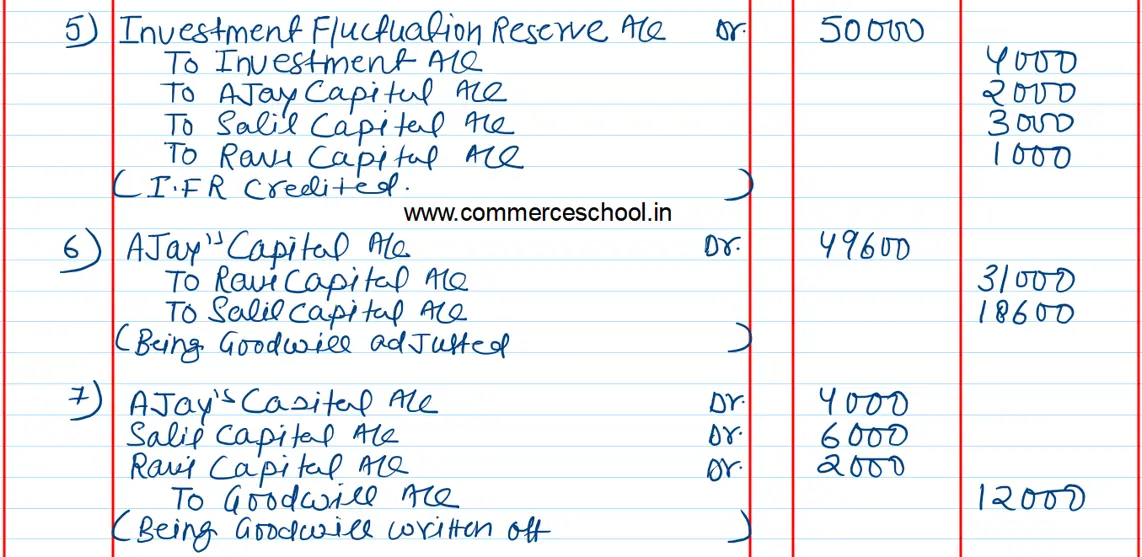

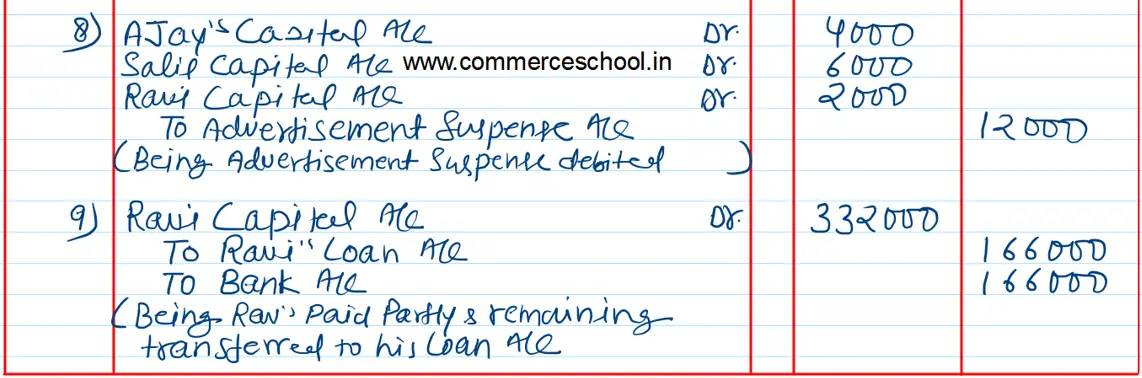

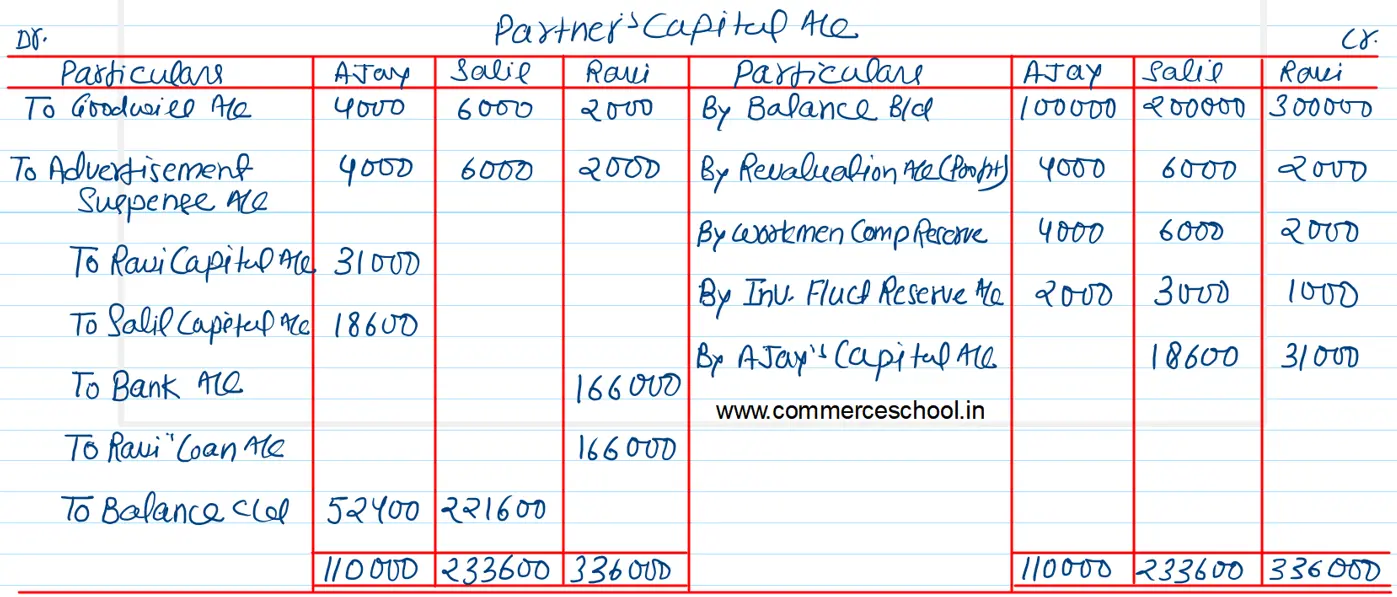

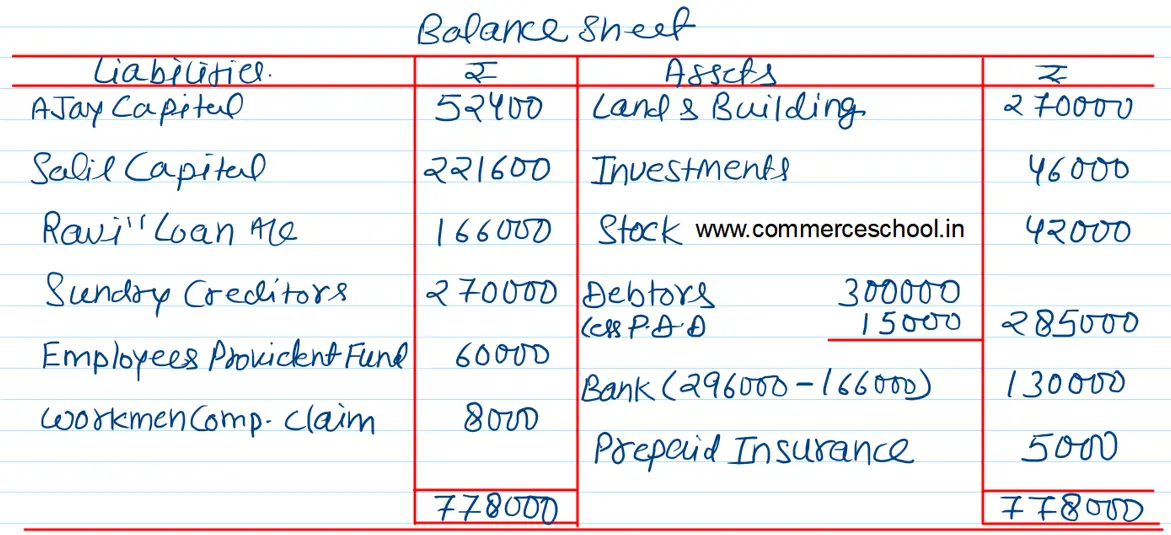

Ravi retired on 1st April, 2023 and Ajay and Salil decide to share future profits and losses in the ratio of 3 : 2. 50% is to be paid to Ravi immediately and the balance in two equal annual instalments together with interest @ 10% p.a. Other terms of retirement are:

(i) Goodwill is to be valued at 2 year’s purchase of average profits of last three completed years. The profits were 2020 – 21 – ₹ 48,000, 2021 – 22 – ₹ 93,000, 2022 – 23 – ₹ 1,38,000.

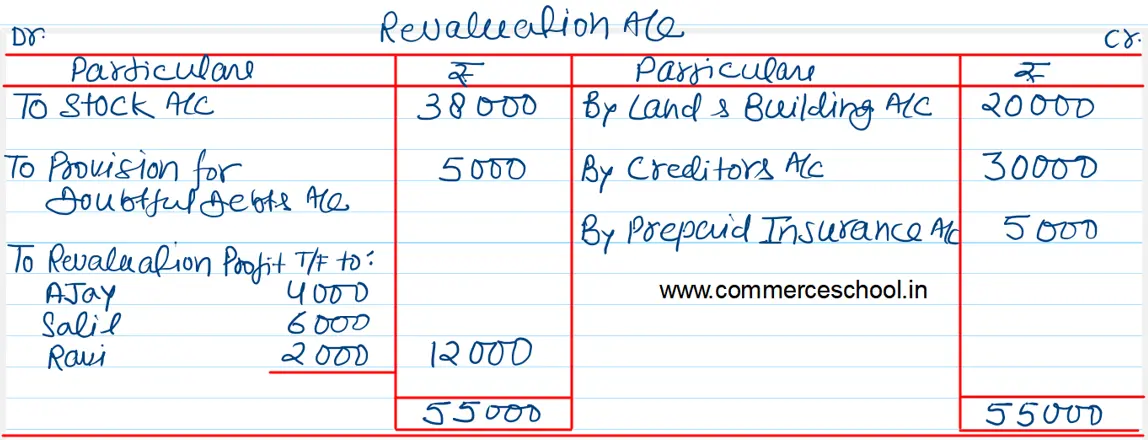

(ii) Land and Building was found undervalued by ₹ 20,000 and Stock was found overvalued by ₹ 38,000.

(iii) Provision for doubtful debts is to be made equal to 5% of the debtors.

(iv) Claim on account of workmen compensation is ₹ 8,000.

(v) 10% of the sundry creditors be written back as no longer payable.

(vi) Out of the amount of insurance which was debited to Profit and Loss Account, ₹ 5,000 be carried forward as an unexpired insurance.

Pass necessary Journal entries and prepare necessary Ledger Accounts and Balance Sheet.