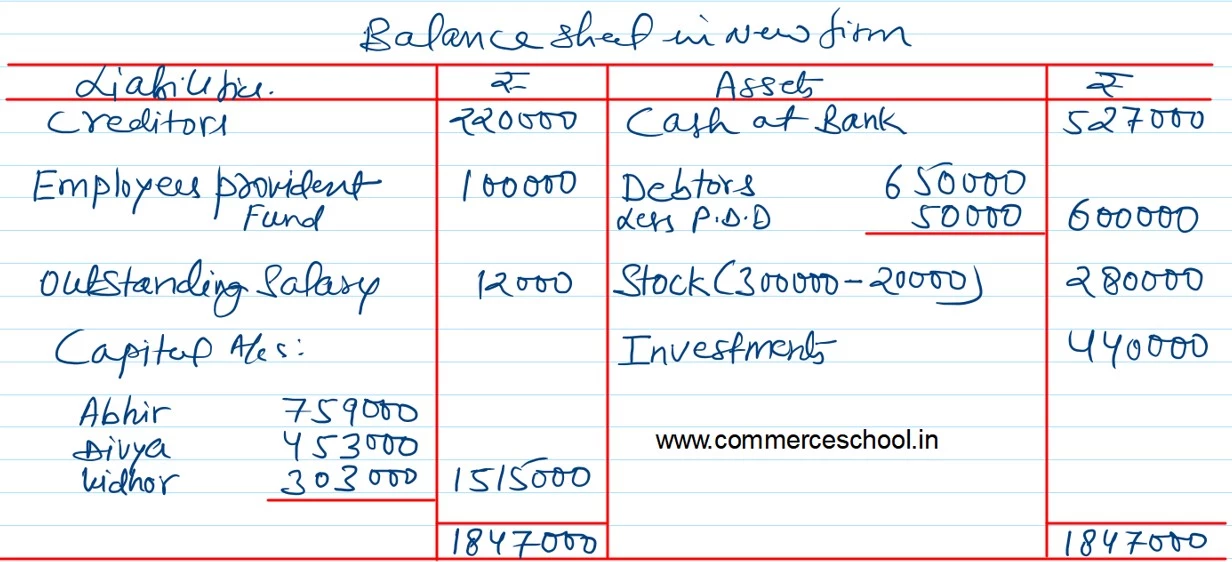

On 31st March 2017, the Balance Sheet of Abhir and Divya, who were sharing profits in the ratio of 3 : 1 was as follows:

On 31st March 2017, the Balance Sheet of Abhir and Divya, who were sharing profits in the ratio of 3 : 1 was as follows:

| Liabilities | ₹ | Assets | ₹ | ||

| Creditors

Employee’s Provident Fund Investment Fluctuation Reserve General Reserve Capitals: Abhir Divya |

6,00,000 4,00,000

|

2,20,000 1,00,000 1,00,000 1,20,000

10,00,000 |

Cash at Bank

Debtors Stock Investments (Market Value ₹ 4,40,000) |

6,50,000

|

1,40,000 6,00,000 3,00,000 5,00,000 |

| 15,40,000 | 15,40,000 |

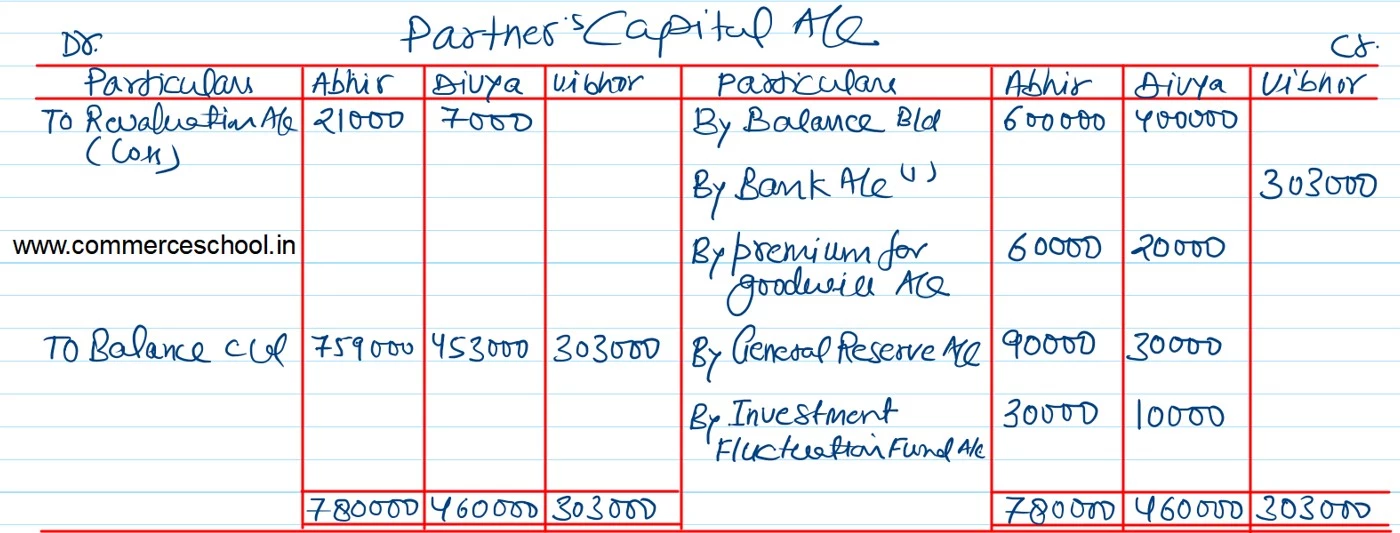

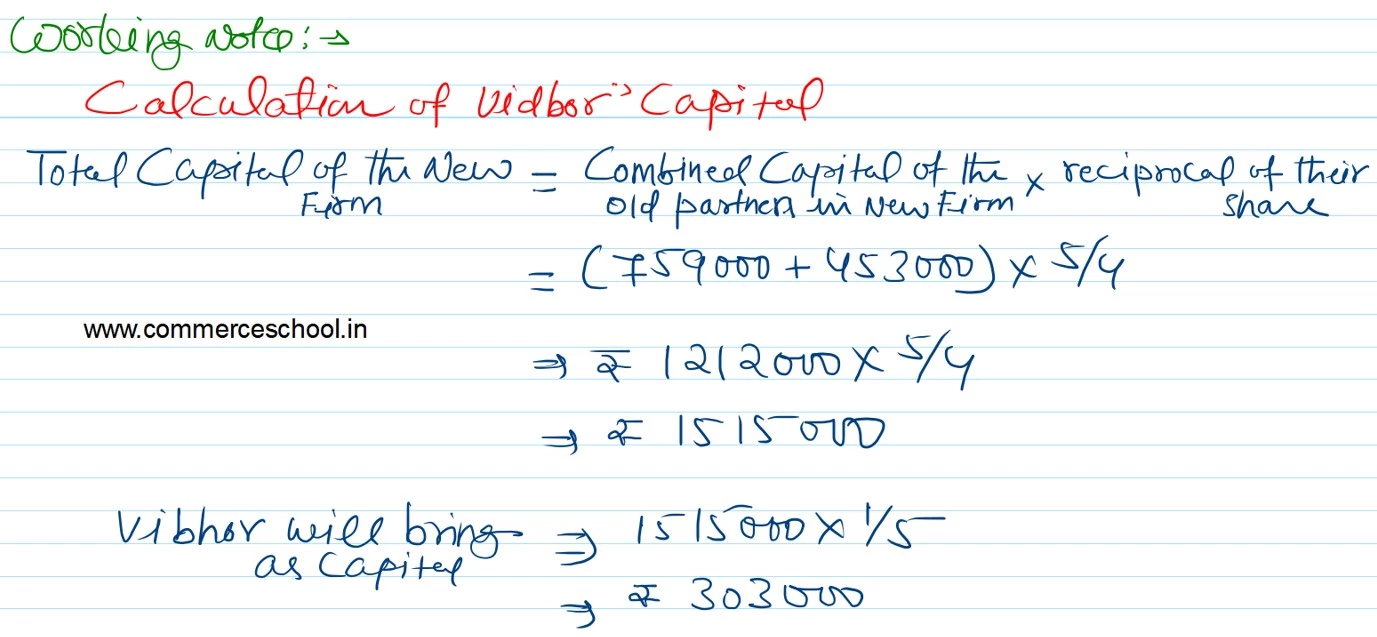

They decided to admit Vibhor on 1st April, 2017 for 1/5th share.

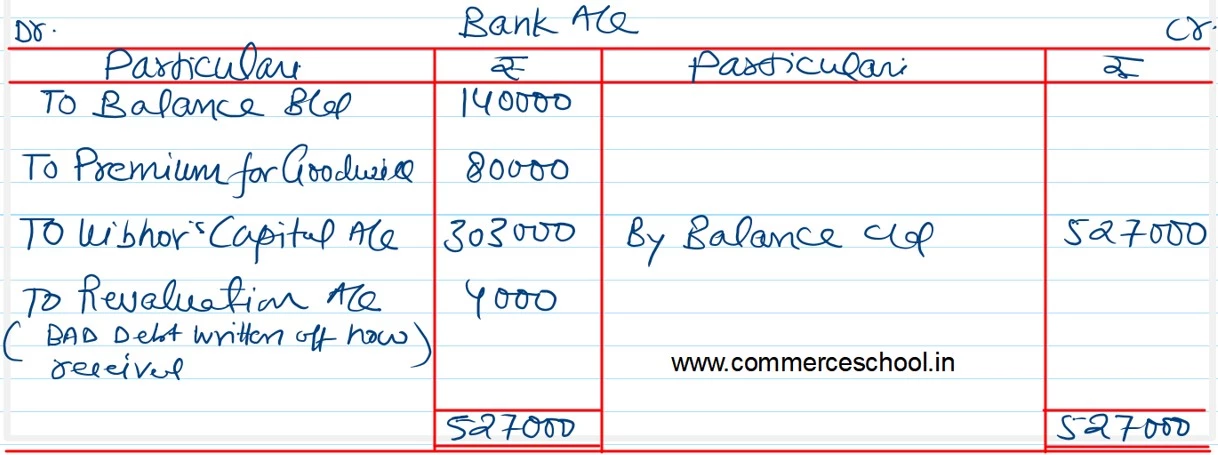

a) Vibhor shall bring ₹ 80,000 as his share of goodwill premium

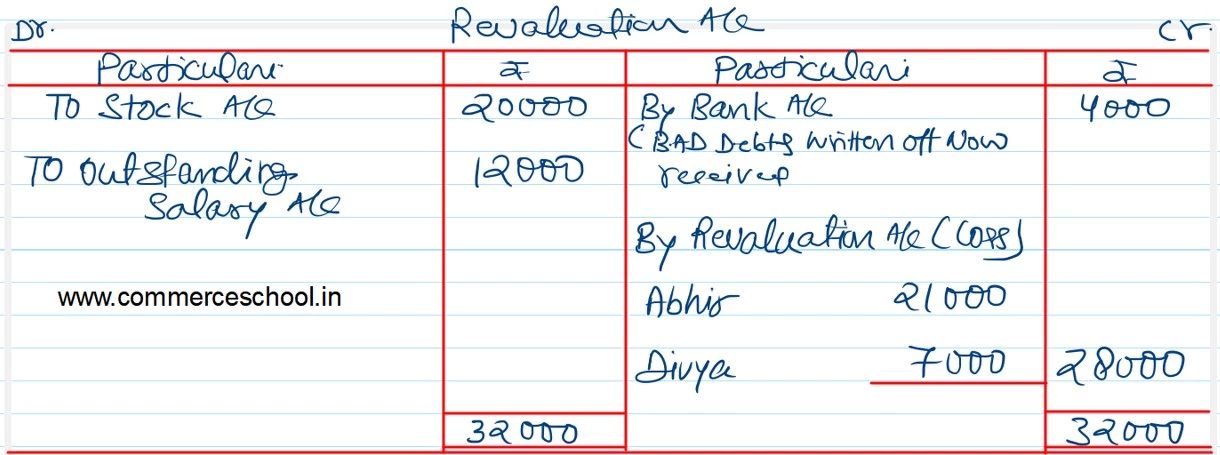

b) Stock was overvalued by ₹ 20,000.

c) A debtor whose dues of ₹ 5,000 were written off as bad debts, paid ₹ 4,000 in full settlement.

d) Two months’ salary @ ₹ 6,000 per month was outstanding.

e) Vibhor was to bring in capital to the extent of 1/5th of the total capital of the new firm.

Prepare Revaluation Account, Partner’s Capital Accounts and the Balance Sheet of the reconstituted firm.

There is a fluctuation of ₹ 60,000 in investments. It is adjusted from Investment Fluctuation Reserve. 1,00,000 – 60,000 = ₹ 40,000.

How investment fluctuation fund came 40,000 in partners capital account?