Pass necessary Journal entries for the following transactions, on the dissolution of a partnership firm of Kavita and Suman on 31st March, 2022, after the various assets (other than cash) and third party liabilities have been transferred to Realisation Account

Pass necessary Journal entries for the following transactions, on the dissolution of a partnership firm of Kavita and Suman on 31st March, 2022, after the various assets (other than cash) and third party liabilities have been transferred to Realisation Account.

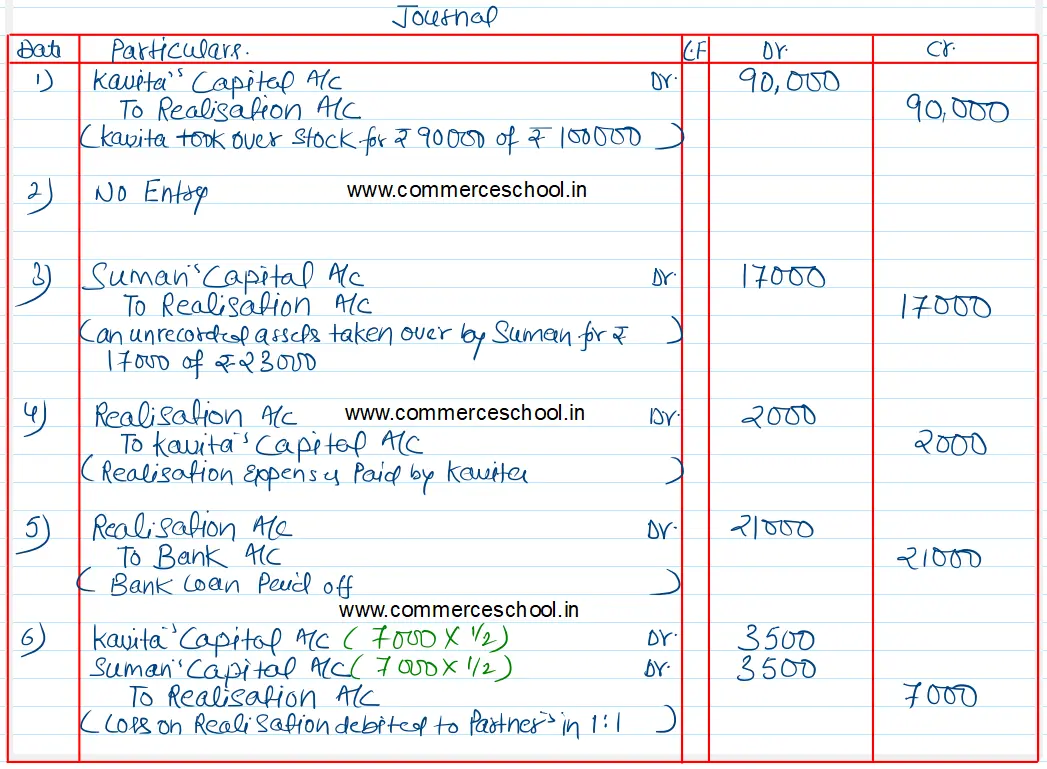

(a) Kavita took over stock amounting to ₹ 1,00,000 at ₹ 90,000.

(b) Creditors of ₹ 2,00,000 took over Plant and Machinery of ₹ 3,00,000 in full settlement of their claim.

(c) There was an unrecorded asset of ₹ 23,000 which was taken over by Suman at ₹ 17,000.

(d) Realisation expenses ₹ 2,000 were paid by Kavita.

(e) Bank Loan of ₹ 21,000 was paid off.

(f) Loss on dissolution amounted to ₹ 7,000.

Anurag Pathak Answered question