Pradeep and Paresh partners in a firm decided to dissolve their partnership firm on 1st April, 2024. Pradeep was deputed to realise the assets and to pay off the liabilities

Pradeep and Paresh partners in a firm decided to dissolve their partnership firm on 1st April, 2024. Pradeep was deputed to realise the assets and to pay off the liabilities. He was paid ₹ 10,000 as commission for his services. Balance Sheet of the firm on 31st March, 2024 was as follows:

Following terms and conditions were agreed upon:

(a) Pradeep agreed to pay his wife’s loan.

(b) Investment was given to Paresh for ₹ 27,000.

(c) BUilding realised ₹ 3,50,000.

(d) Creditors were to be paid after two months, they were paid immediately at 10% p.a. discount.

(e) Realisation expenses were ₹ 2,500.

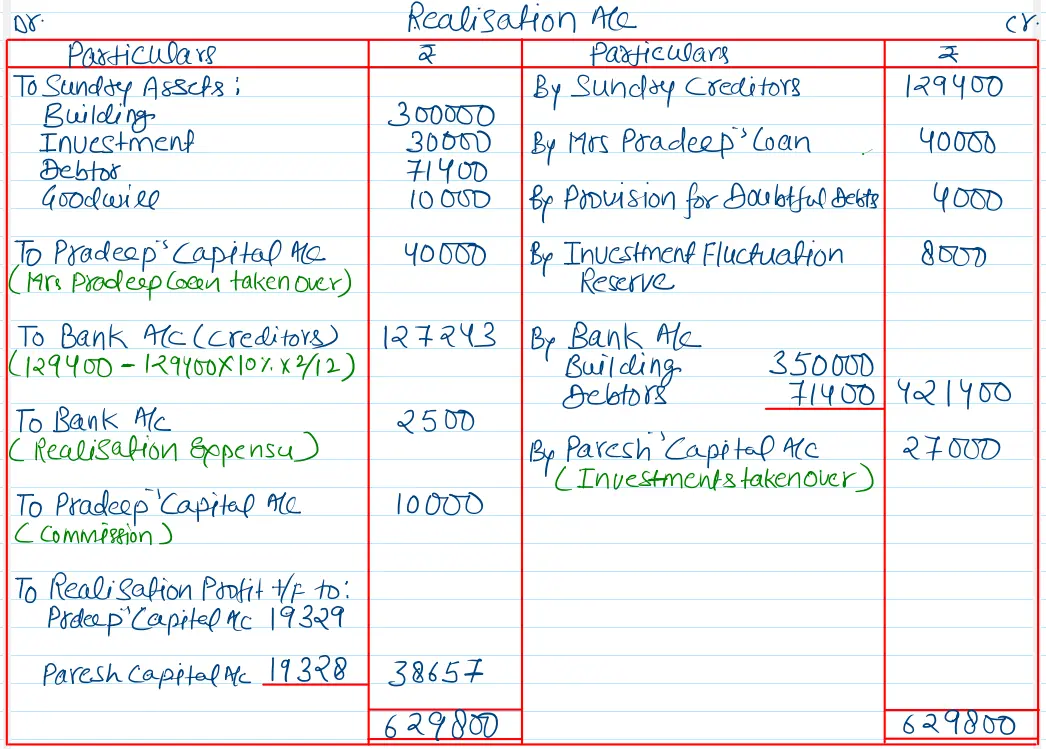

Prepare Realisation Account.

[Ans.: Realisation Gain – ₹ 38,657; Payment to Creditors – ₹ 1,27,243.]

Balance Sheet as at 31st March, 2024

| Liabilities | ₹ | Assets | ₹ | |

| Sundry Creditors Mrs. Pradeep’s Loan Paresh’s Loan Investment Fluctuation Reserve Capital A/cs: Pradeep Paresh | 1,29,400 40,000 24,000 8,000 1,21,000 1,21,000 | Building Investment Debtors Less: Provision for Doubtful Debts Bank Profit & Loss A/c Goodwill | 71,400 4,000 | 3,00,000 30,000 67,400 16,000 20,000 10,000 |

| 4,43,400 | 4,43,400 |

Anurag Pathak Answered question