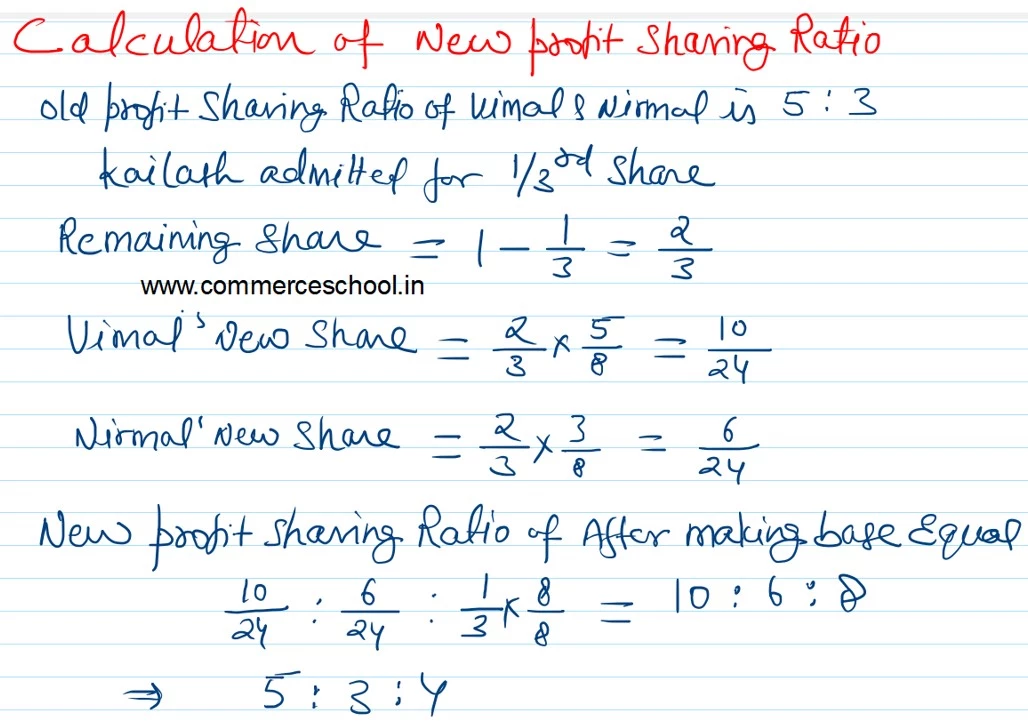

Vimal and Nirmal are partners in a firm sharing profits and losses in the ratio of 5 : 3. They admit Kailash into the firm on 1st April 2023, when their Balance Sheet was as follows:

Vimal and Nirmal are partners in a firm sharing profits and losses in the ratio of 5 : 3. They admit Kailash into the firm on 1st April 2023, when their Balance Sheet was as follows:

| Liabilities | ₹ | Assets | ₹ |

| Vimal’s Capital

Nirmal’s Capital General Reserve Bank Loan Creditors |

32,000 34,000 8,000 6,000 6,000 |

Goodwill

Machinery Furniture Debtors Stock Cash |

8,000 38,000 5,000 23,000 7,000 5,000 |

| 86,000 | 86.000 |

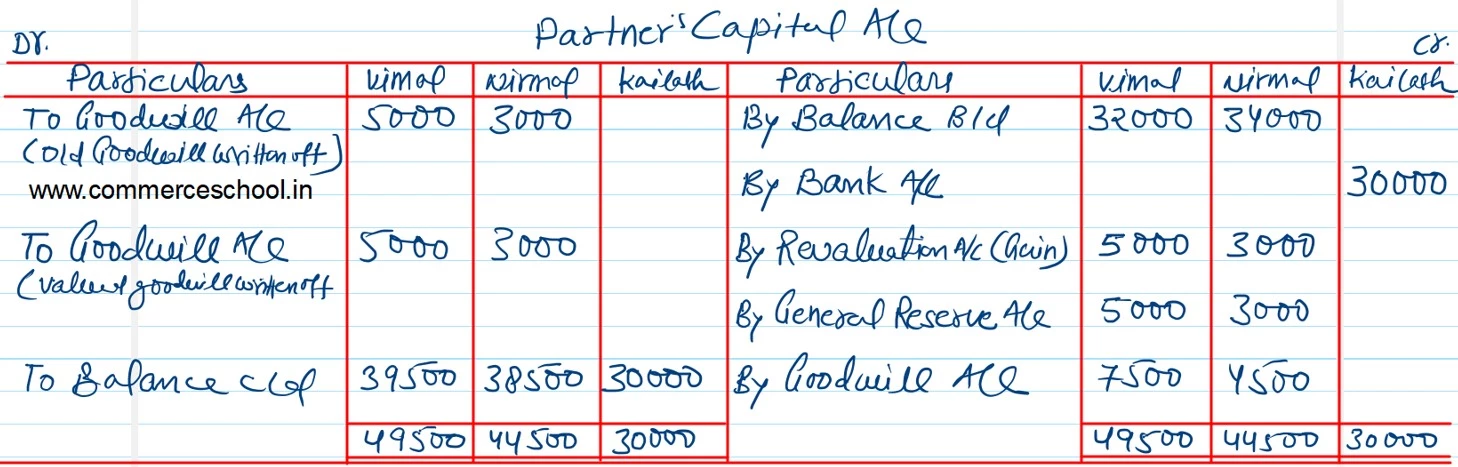

Terms of Kailash’s admission were as follows:

i) Kailash will bring ₹ 30,000 as his share of capital and will be entitled

to 1/3rd share in the profits.

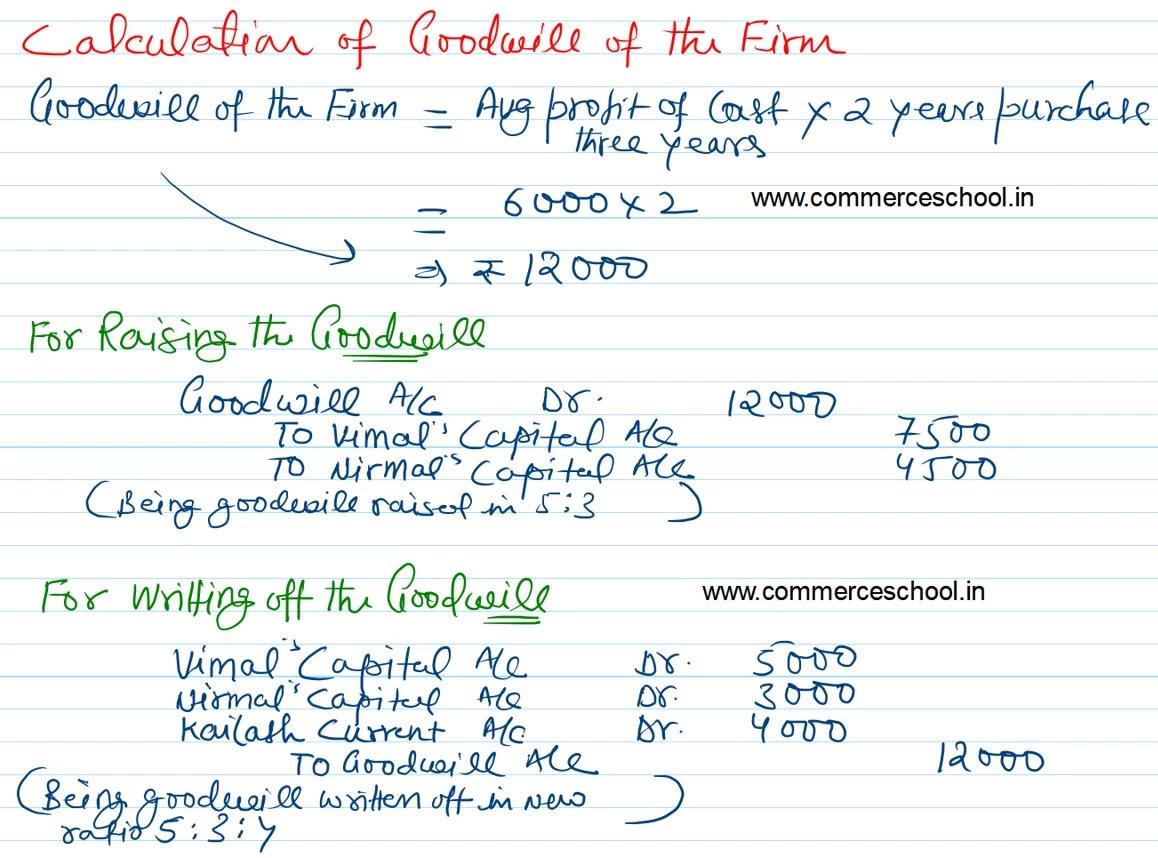

ii) kailash is not to bring goodwill in cash, Vimal and Nirmal raise the goodwill in the books.

iii) Goodwill of the firm is valued on the basis of 2 Year’s purchase of the average profit of the last three years. Average profit of the last three years is ₹ 6,000.

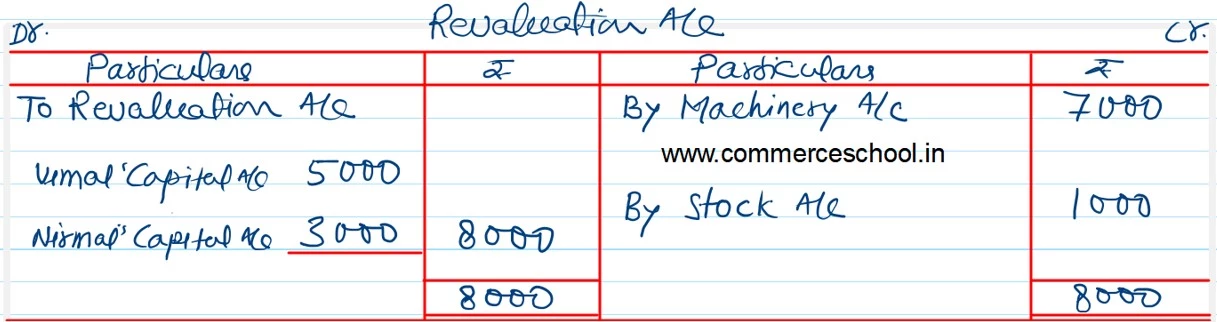

iv) Machinery and stock are revalued at ₹ 45,000 and ₹ 8,000 respectively

Prepare a Revaluation Account and Partner’s Capital Accounts incorporating the above adjustments.