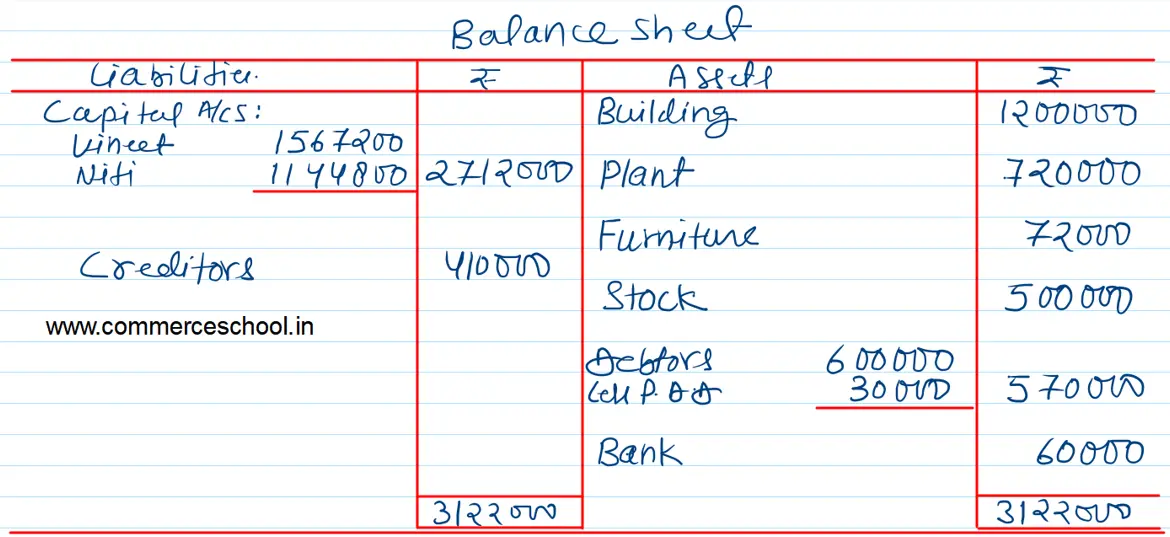

Vineet, Neeti and Umeed are partners sharing profits and losses in the ratio of 3 : 2 : 1. Their Balance Sheet as at 31st March, 2023 was as follows:

Vineet, Neeti and Umeed are partners sharing profits and losses in the ratio of 3 : 2 : 1. Their Balance Sheet as at 31st March, 2023 was as follows:

| Liabilities | ₹ | Assets | ₹ |

|

Capital A/cs: Vineet Neeti Umeed General Reserve Workmen Compensation Reserve Creditors |

9,00,000 7,00,000 5,00,000 3,30,000 2,40,000 4,10,000 |

Building Plant Furniture Stock Debtors Cash at Bank Advertisement Suspense A/c |

10,00,000 8,00,000 80,000 5,00,000 6,00,000 70,000 30,000 |

| 30,80,000 | 30,80,000 |

Umeed retired on 1st April, 2023 and for that purpose:

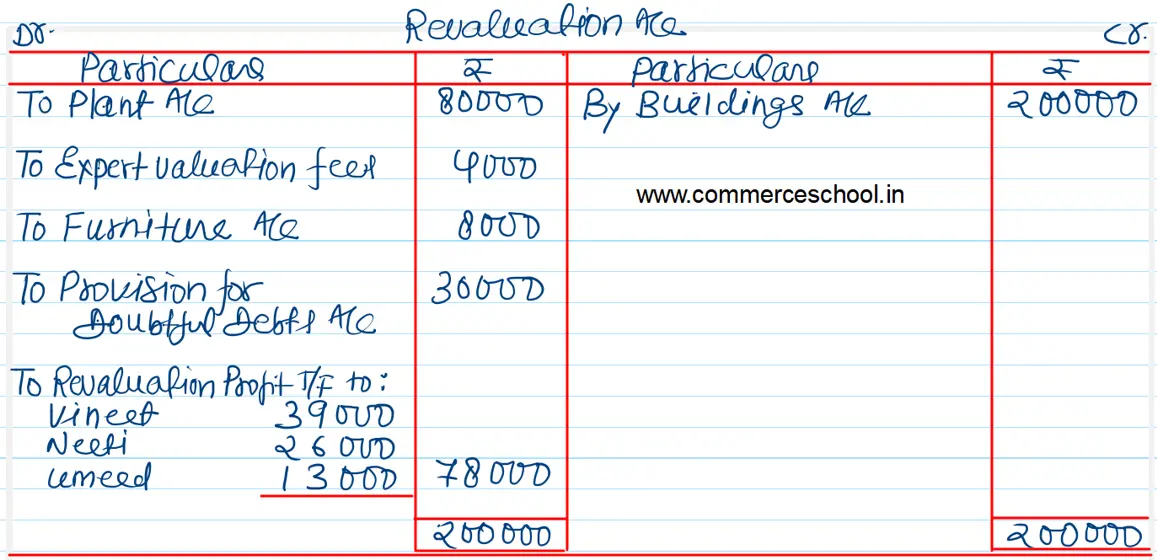

(i) Goodwill of the firm valued at ₹ 7,20,000. Umeed’s share is to be adjusted in the accounts of Vineet and Neeti.

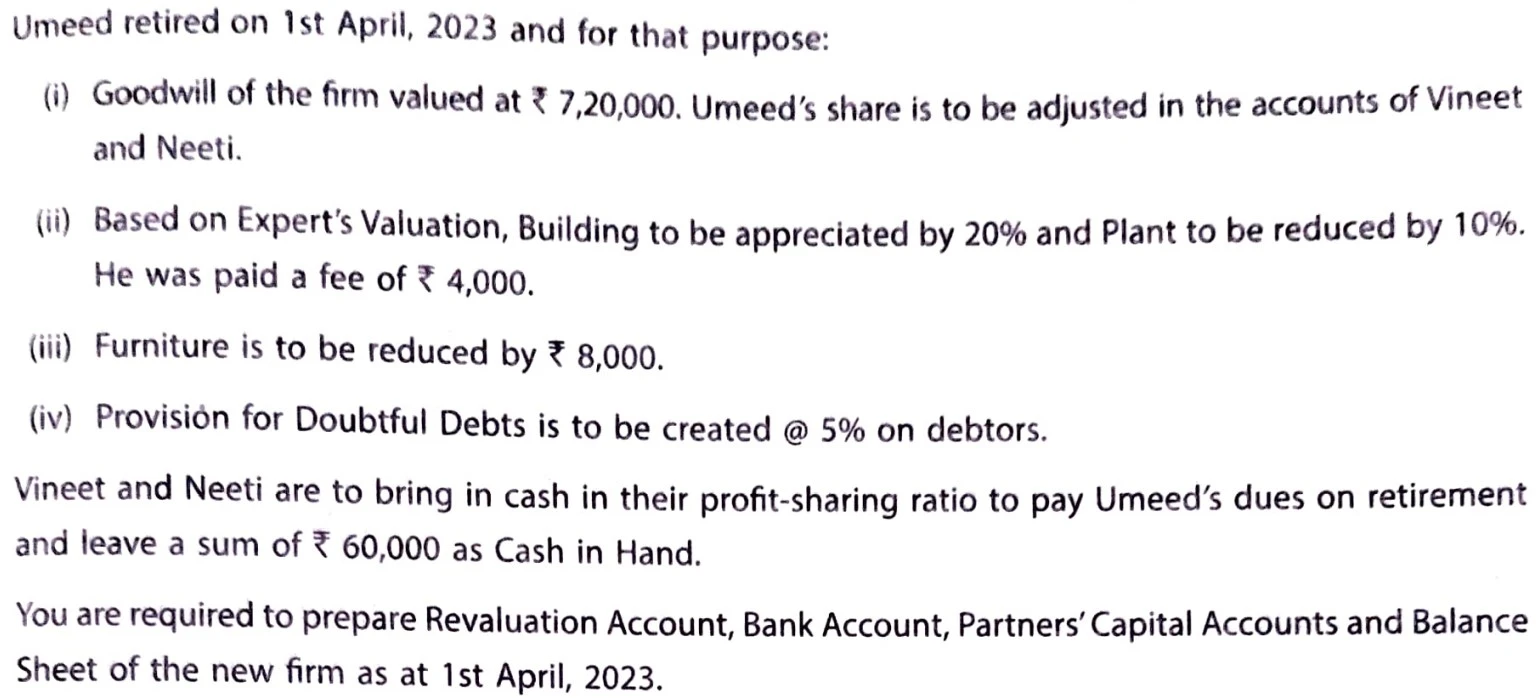

(ii) Based on Expert’s Valuation, Building to be appreciated by 20% and Plant to be reduced by 10%. He was paid a fee of ₹ 4,000.

(iii) Furniture is to be reduced by ₹ 8,000.

(iv) Provision for Doubtful Debts is to be created @ 5% on debtors.

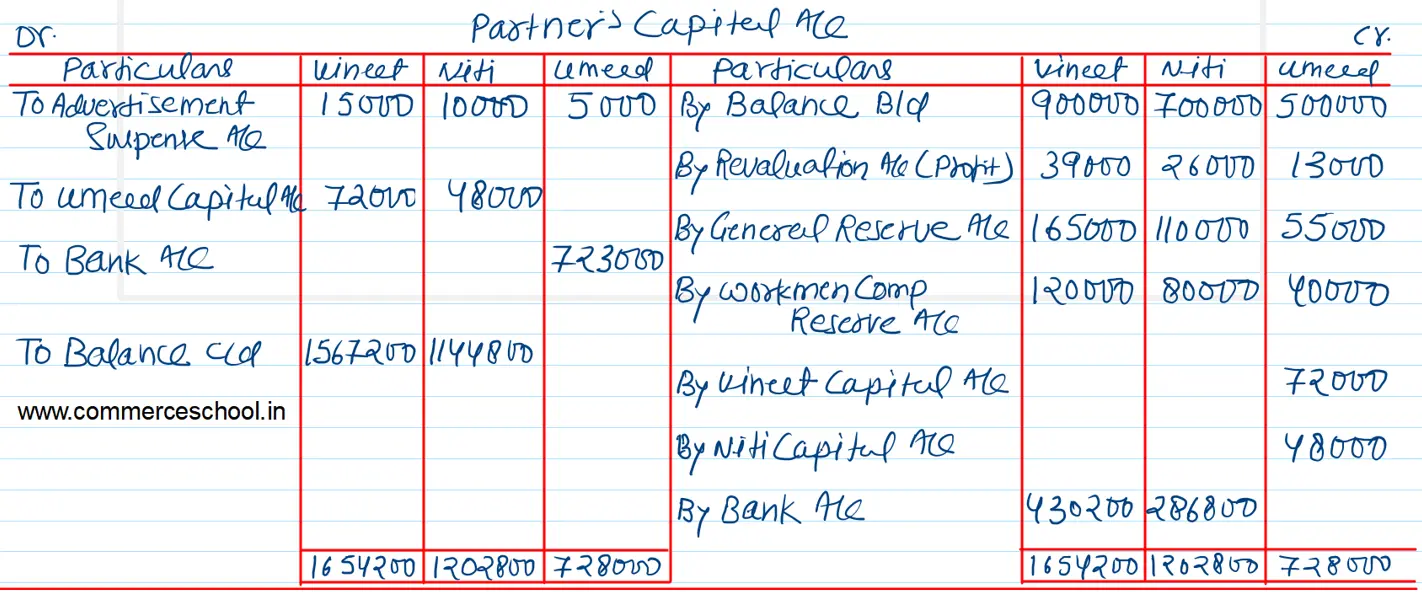

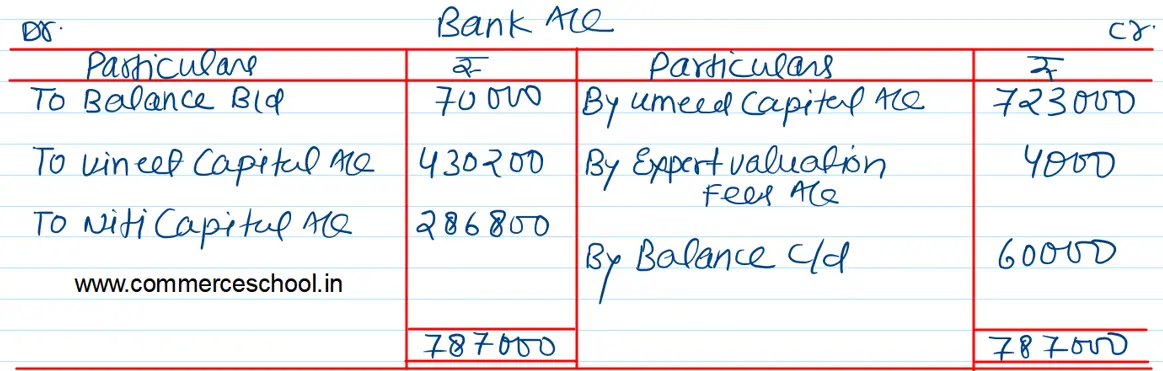

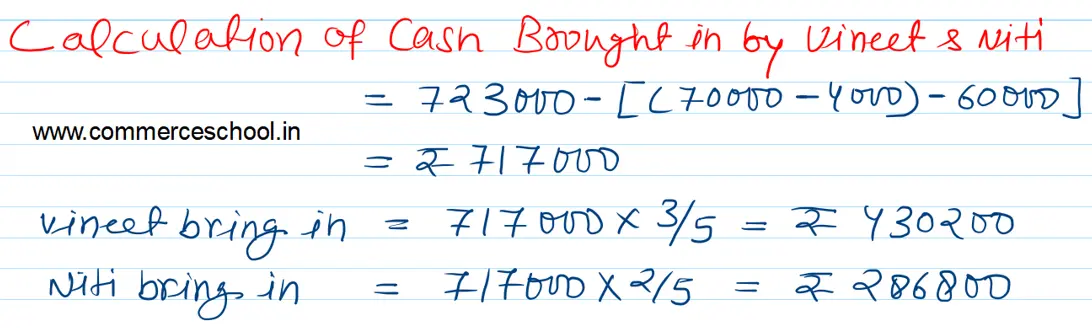

Vineet and Neeti are to bring in cash in their profit sharing ratio to pay Umeed’s dues on retirement.and leave a sum of ₹ 60,000 as Cash in Hand.

You are required to prepare Revaluation Account. Bank Account , Partner’s Capita Accounts and Balance Sheet of the new firm as at 1st April, 2023.