Cheese and Slice are equal partners. Their capitals as on April 01, 2022 were ₹ 50,000 and ₹ 1,00,000 respectively. After the accounts for the financial year ending March 31, 2023 have been prepared

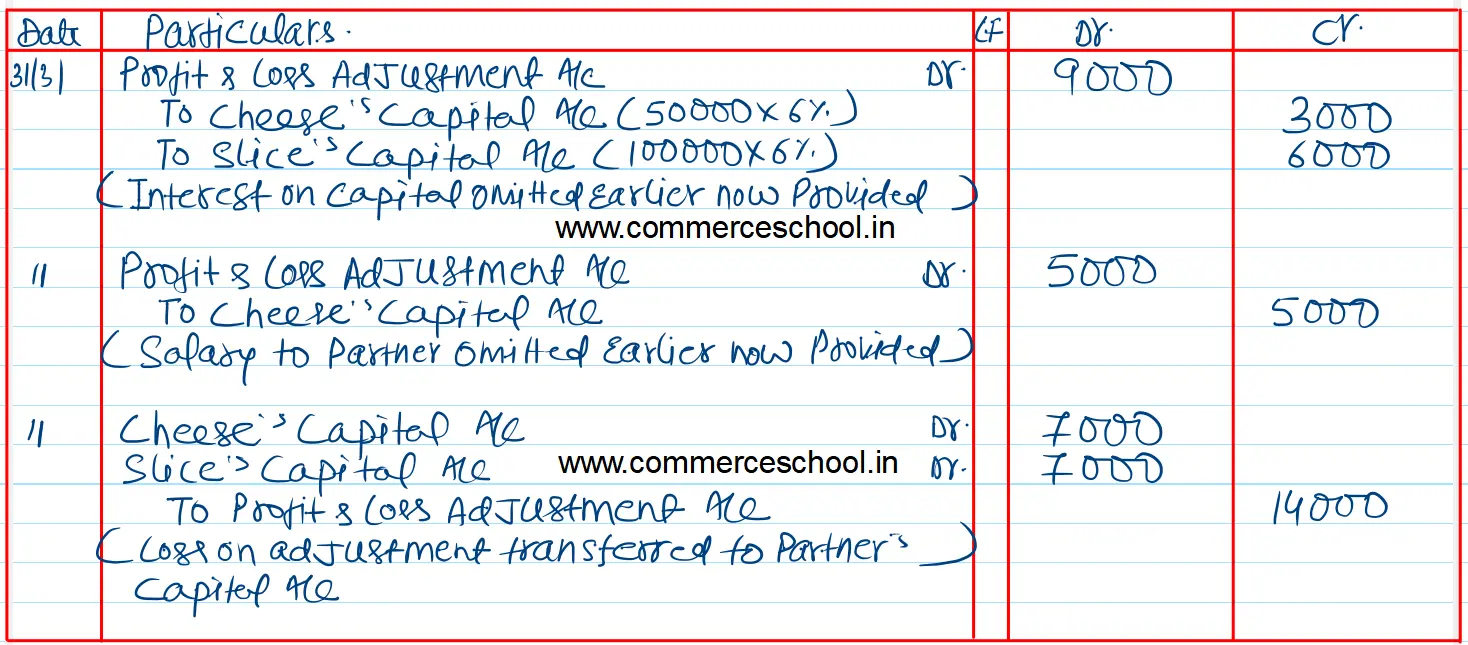

Cheese and Slice are equal partners. Their capitals as on April 01, 2022 were ₹ 50,000 and ₹ 1,00,000 respectively. After the accounts for the financial year ending March 31, 2023 have been prepared, it is observed that interest on capital @ 6% per annum and salary to Cheese @ ₹ 5,000 per annum, as provided in the partnership deed has not been credited to the partner’s capital accounts before distribution of profits.

You are required to give necessary rectifying entries using P&L adjustment account.

[Ans. Loss of P & L Adjustment A/c debited to partners ₹ 7,000 each.]

Anurag Pathak Answered question May 29, 2024