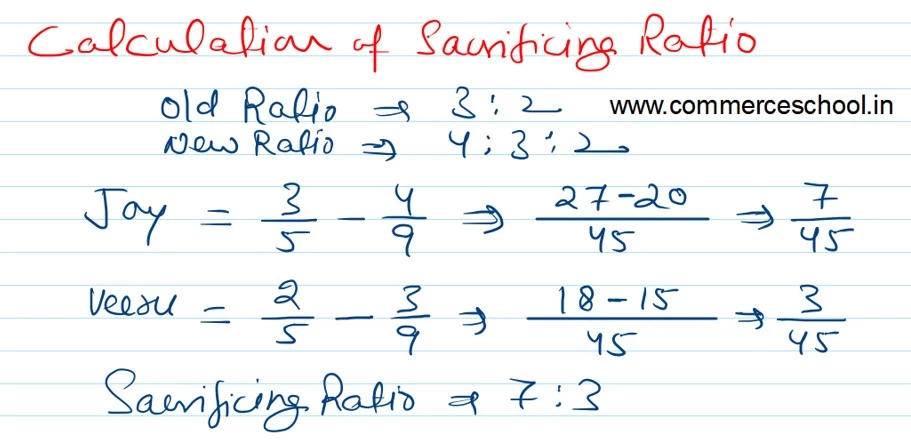

Following is the Balance Sheet of Jay and Veeru as at 31st March, 2023 who are partners in a firm sharing profits and losses in the ratio of 3 : 2 respectively.

Following is the Balance Sheet of Jay and Veeru as at 31st March, 2023 who are partners in a firm sharing profits and losses in the ratio of 3 : 2 respectively.

| Liabilities | ₹ | Assets | ₹ | |

| Creditors

General Reserve Capital A/cs: Jay Veeru Current A/cs: Jay Veeru |

45,000

36,000

1,80,000 90,000

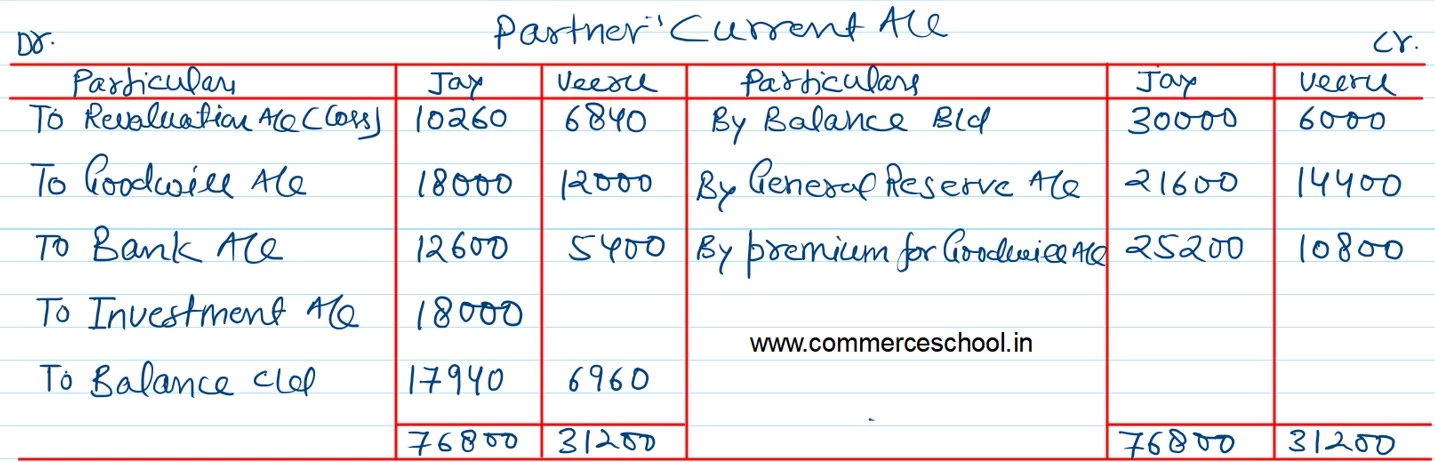

30,000 6,000 |

Cash at Bank

Debtors Patents Investments Fixed Assets Goodwill |

60,000

|

15,000

57,600 44,400 24,000 2,16,000 30,000 |

| 3,87,000 | 3,87,000 |

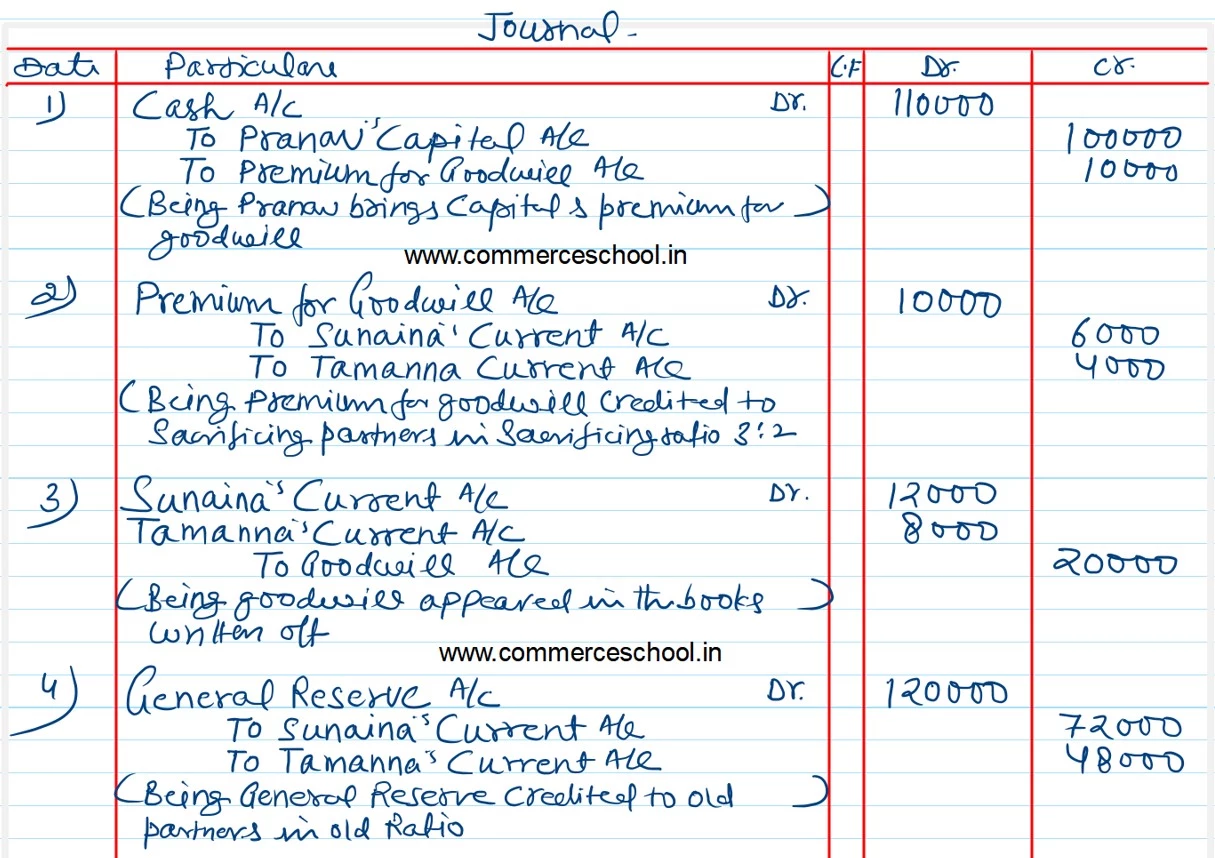

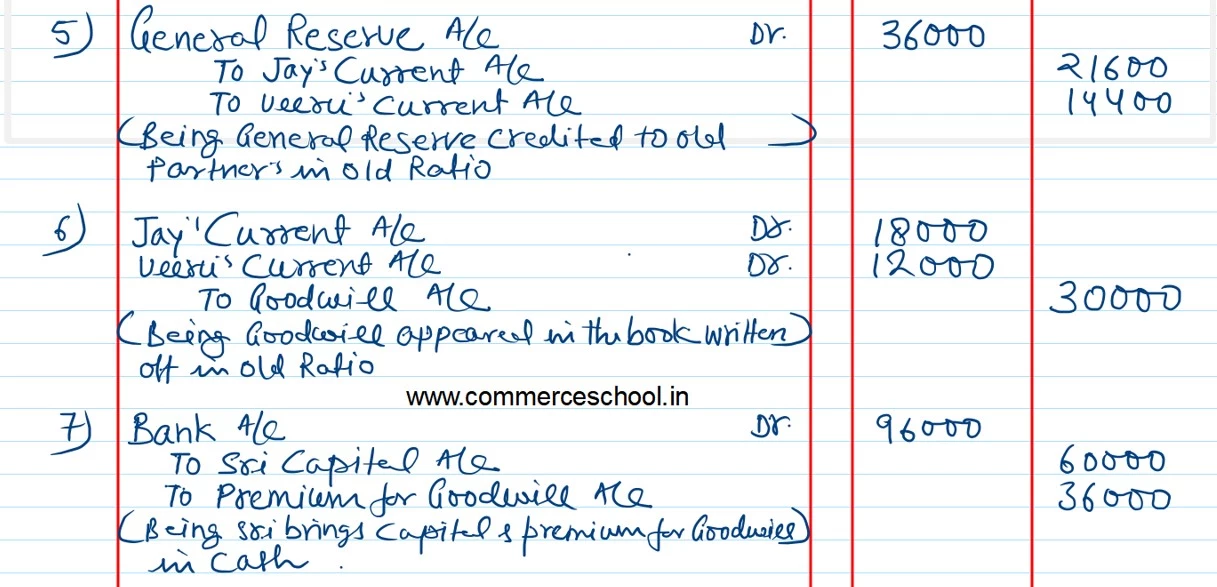

Sri is admitted as a new partner on 1st April, 2023 on the following terms:

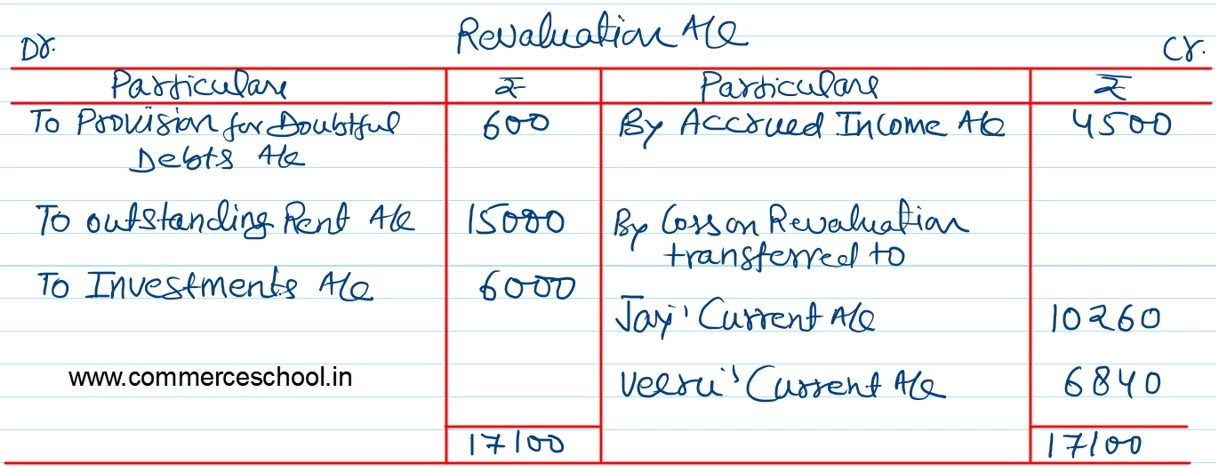

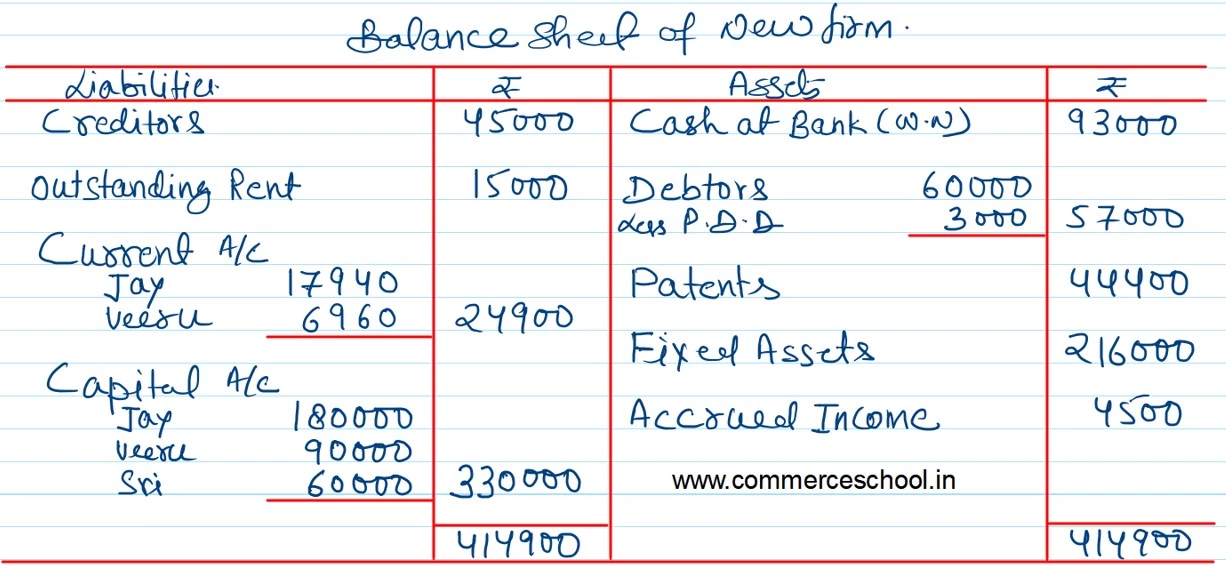

a) Provision for doubtful debts is to be maintained at 5 % on Debtors.

b) Outstanding rent payable was ₹ 15,000.

c) An accrued income of ₹ 4,500 does not appear in the books of the firm. it is now to be recorded.

d) Jay takes over the investments at an agreed value of ₹ 18,000.

e) New Profit sharing Ratio of partners will be 4 : 3 : 2.

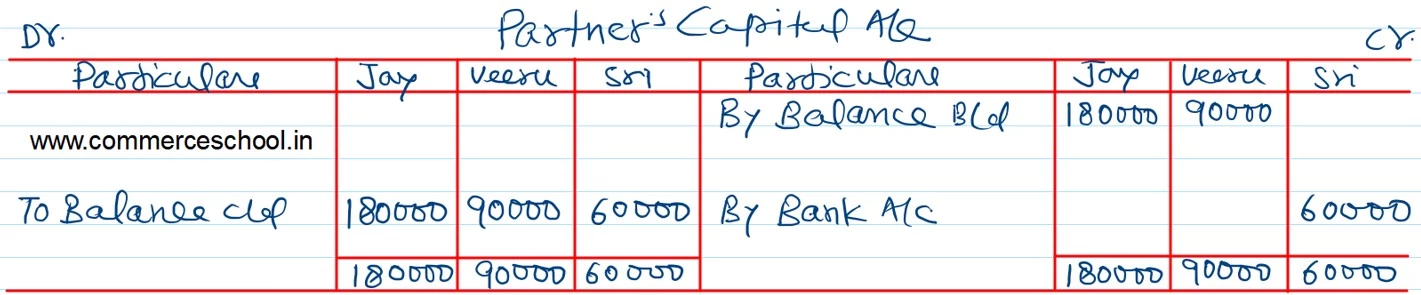

f) Sri will bring in ₹ 60,000 as his capital by cheque.

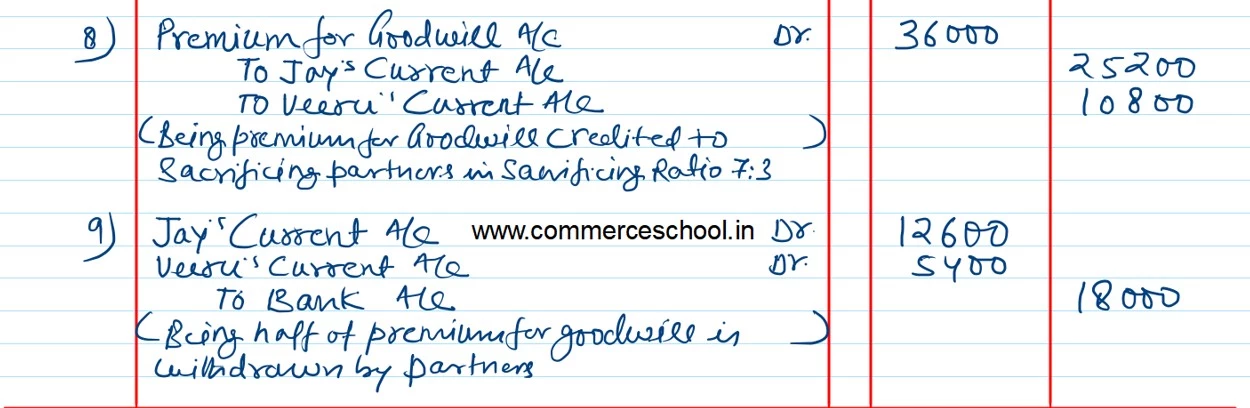

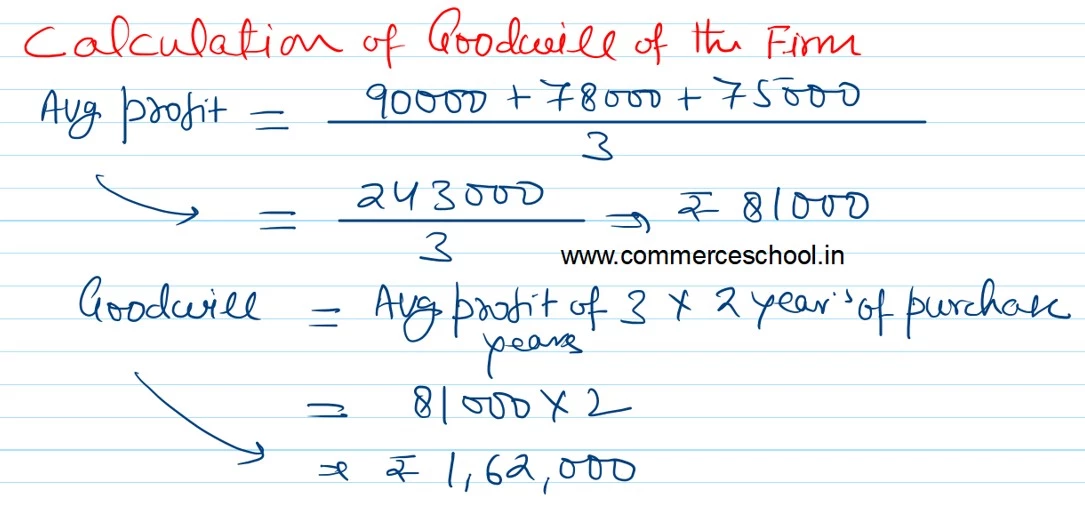

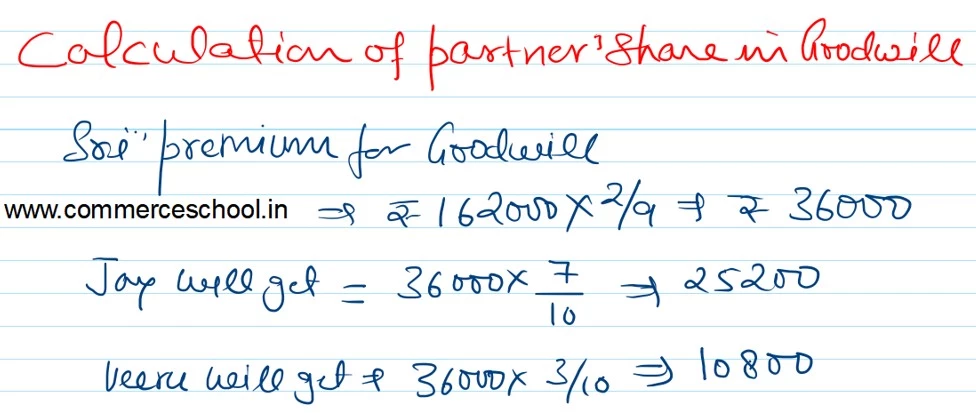

g) Sri is to pay an amount equal to his share in firm’s goodwill valued at twice the average profit of the last three years ended 31st March, 2023, 2022 and 2021, which were ₹ 90,000; ₹ 78,000 and ₹ 75,000 respectively.

h) Half of the amount of goodwill is to be withdrawn by Jay and Veeru.

You are required to pass Jaournal entries, prepare Revaluation Account, Partner’s Capital and Current Accounts and the Balance Sheet of the new firm.