C, D and E were partners in a firm sharing profits in the ratio of 3 : 1 : 1. Their Balance Sheet as at 31st March, 2022 was as follows

C, D and E were partners in a firm sharing profits in the ratio of 3 : 1 : 1. Their Balance Sheet as at 31st March, 2022 was as follows:

Balance sheet of C, D and E as at 31st March, 2022

| Liabilities | ₹ | Assets | ₹ |

|

Capital A/cs: C D E C’s Loan Sundry Creditors Bills Payable |

4,00,000 2,00,000 1,00,000 1,20,000 1,00,000 2,00,000 |

Machinery Investments Stock Debtors Cash at Bank |

3,20,000 3,00,000 2,00,000 1,00,000 2,00,000 |

| 11,20,000 | 11,20,000 |

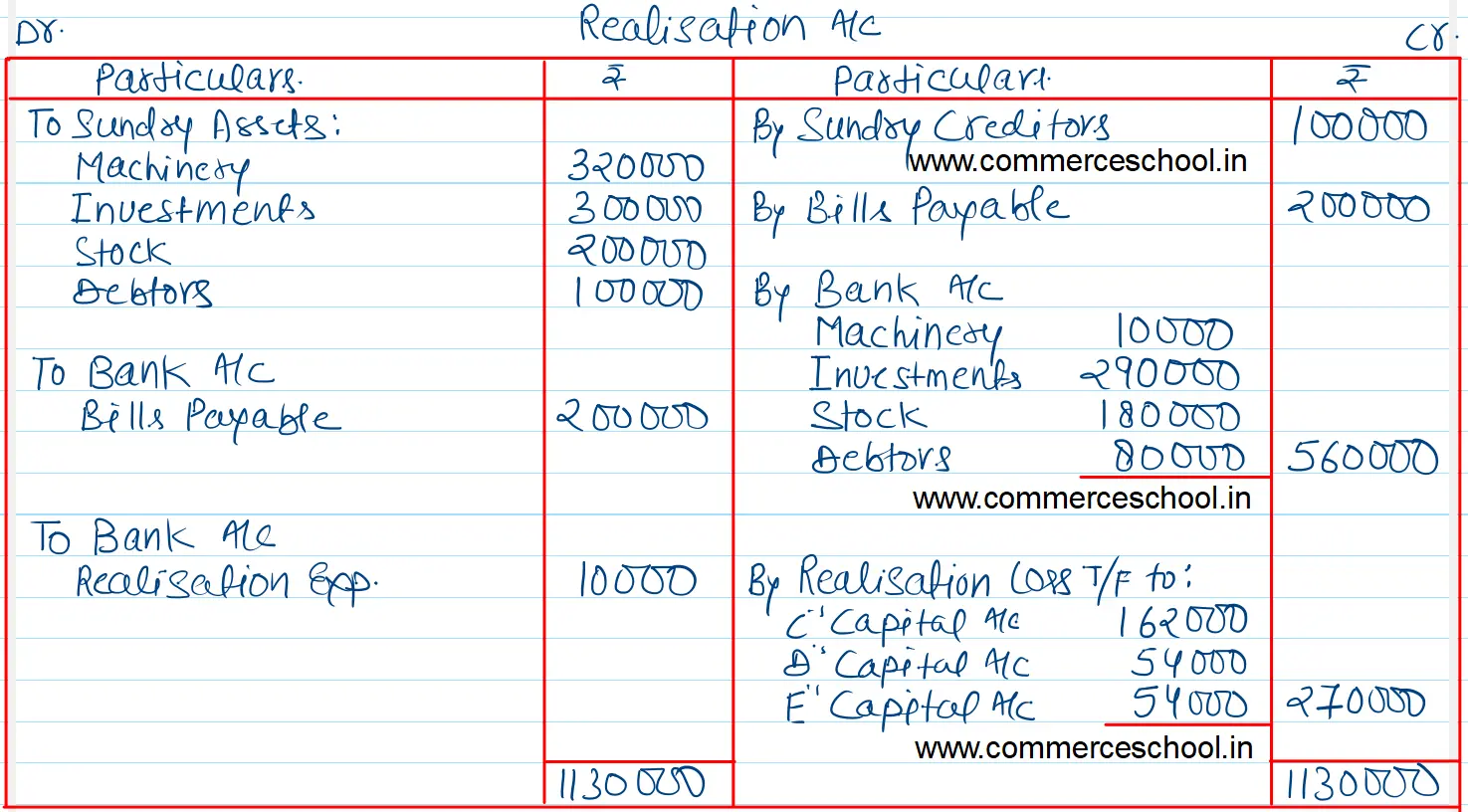

On the above date, the firm was dissolved due to certain disagreement among the partners.

(I) Machinery of ₹ 3,00,000 were given to creditors in full settlement of their account and remaining machinery was sold for ₹ 10,000.

(ii) Investments realised ₹ 2,90,000.

(iii) Stock was sold for ₹ 1,80,000.

(iv) Debtors for ₹ 20,000 proved bad.

(v) Realisation expenses amounted to ₹ 10,000.

Prepare Realisation Account.

[Ans.: Loss on Realisation – ₹ 2,70,000.]