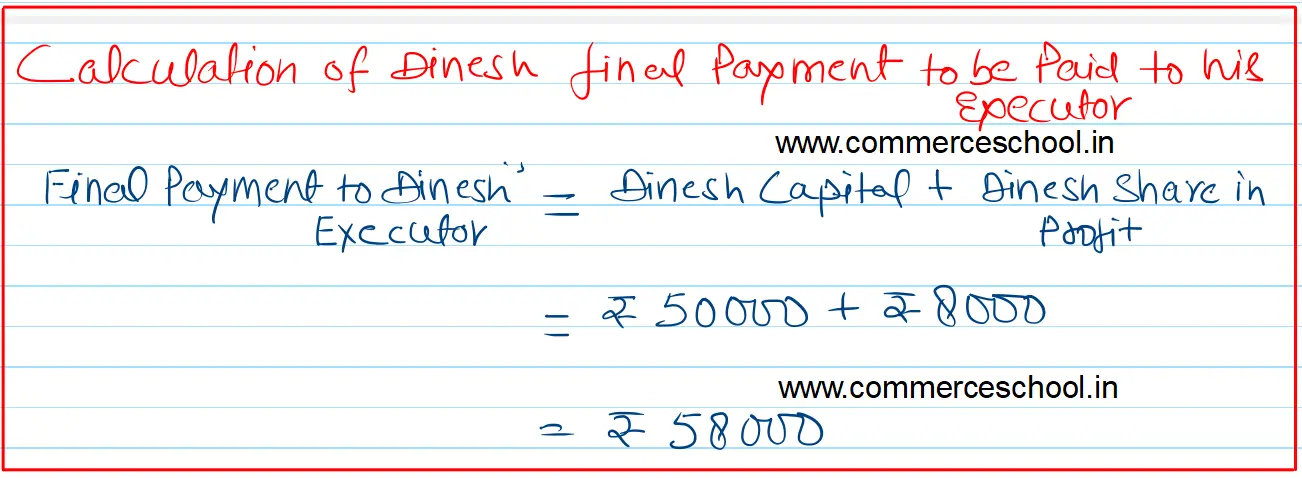

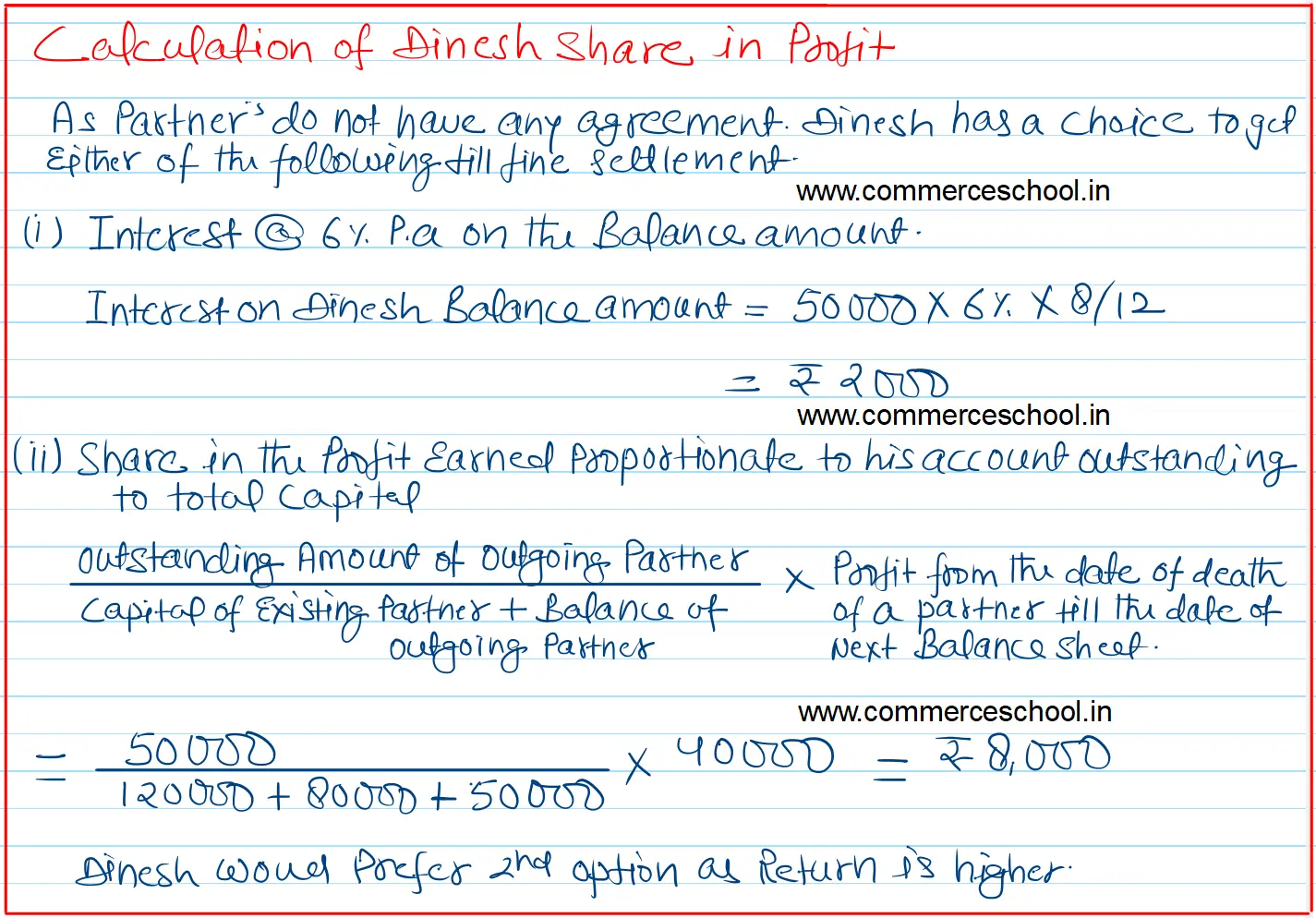

Ramesh, Suresh and Dinesh were partners sharing profits and losses in the ratio of 3 : 2 : 1. Dinesh died on 1st May, 2023 on which date the capitals of Ramesh

Ramesh, Suresh and Dinesh were partners sharing profits and losses in the ratio of 3 : 2 : 1. Dinesh died on 1st May, 2023 on which date the capitals of Ramesh, Suresh and Dinesh after all necessary adjustments stood at ₹ 1,20,000, ₹ 80,000 and ₹ 50,000 respectively. Ramesh and Suresh decide to carry on the business for 8 months without setling the account of Dinesh. During the period of 8 months ended 31st December 2022, profit of ₹ 40,000 is earned by the firm. State which of the two options available with Dinesh’s Executor under Section 37 of the Indian Partnership Act, 1932 should be exercised. Also calculate the total amount payable to Dinesh’s Executor if Ramesh and Suresh clear the dues of Dinesh on 31st December, 2023.